Final Gst Submission Malaysia Guide

The final date for the submission of this final gst return fell on 28 december 2018.

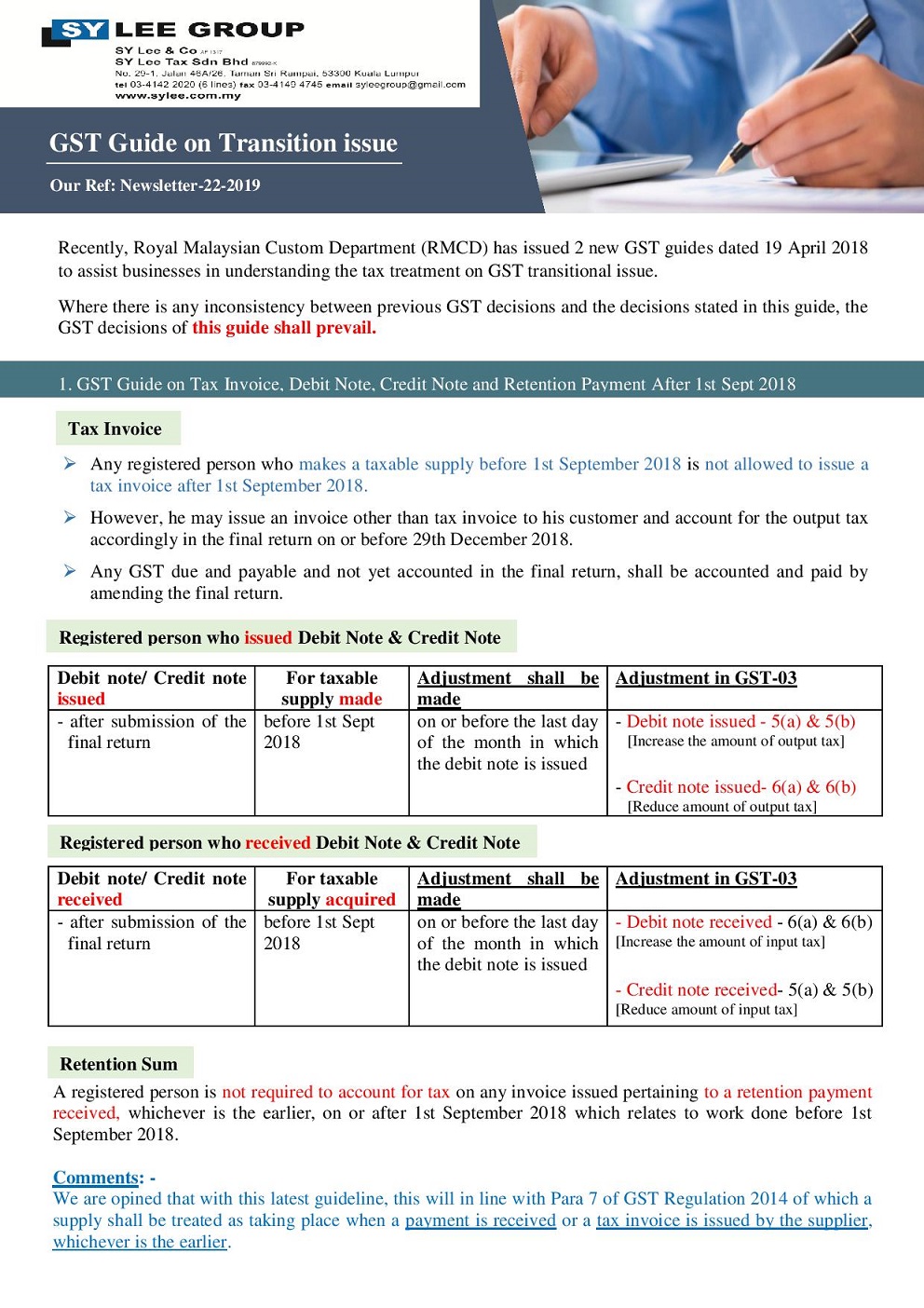

Final gst submission malaysia guide. 1 business registration no. By or before 30 th september 2018. The most significant and controversial issue in terms of the requirements for the final gst return is in relation to post 31 august 2018 transactions with gst implications gst impacted transactions for output tax or input tax purposes e g. This is a reminder to businesses that the amendment to the final gst 03 return if any needs to be made by 31 august 2020.

Amendments to the final gst 03 return if any must be made by 31 august 2020. Submit gst declaration by person other than a taxable person summary. Repeal act 2018 the final gst return was required to be filed by all gst registered persons no later than one hundred and twenty 120 days from the appointed date of 1 september 2018. According to the gst guides no gst adjustment is allowed to be made after 31 august 2020.

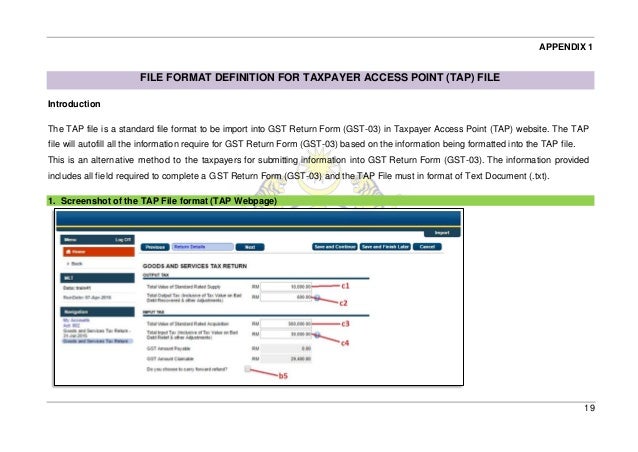

Gst guide on gst 04 online submission. There are two type of id. Amendment to final gst return malaysia s goods and services tax gst was replaced by the sales tax and services tax but there are still transitional gst issues that may need to be resolved. Pos bayaran kepada jabatan kastam malaysia pus at pemprosesan gst aras 1 blok a kompleks kastam wpkl jalan ss 6 3.

The one hundred and twenty 120 days period allocated by the. Adjustments that occur up to the 29 december 2018 filing deadline for the final gst return as well as transactions that occur after this date. Final amendment to gst malaysian gst has abolished since 1 september 2018 it was a historical moment as malaysia is the first country who abolished gst. Amendment to final gst return due by 31 august 2020 malaysia.

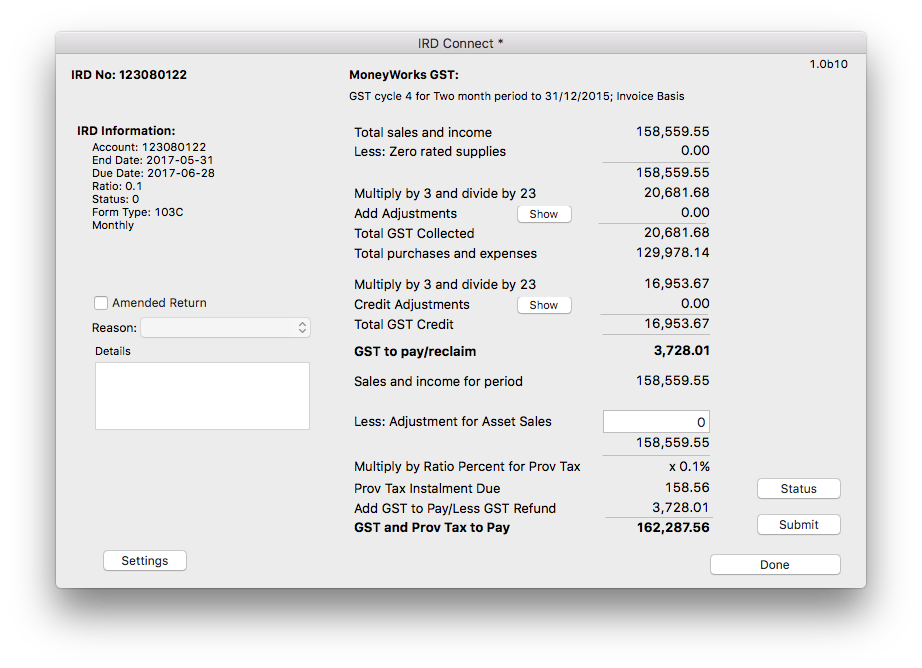

Gst guide on tax invoice debit note credit note and retention payment after 1 september 2018. Final submission gst 04 return please be informed that pursuant to section 7 of goods and service tax repeal act 2018 the non gst registrants are required to submit the final gst 04 return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 30 days from 01 09 2018 i e. All gst registrants are required to submit the gst 03 return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01 09 2018 to 29 12 2018.