How To Get Ea Form 2018

Majikan yang telah m e n ghantar maklumat melalui e data praisi tidak perlu mengisi dan menghantar borang c p 8d.

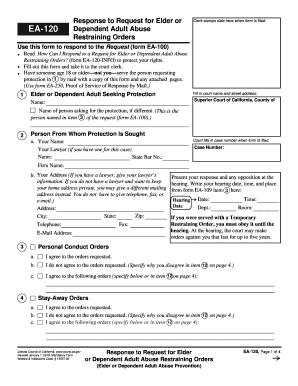

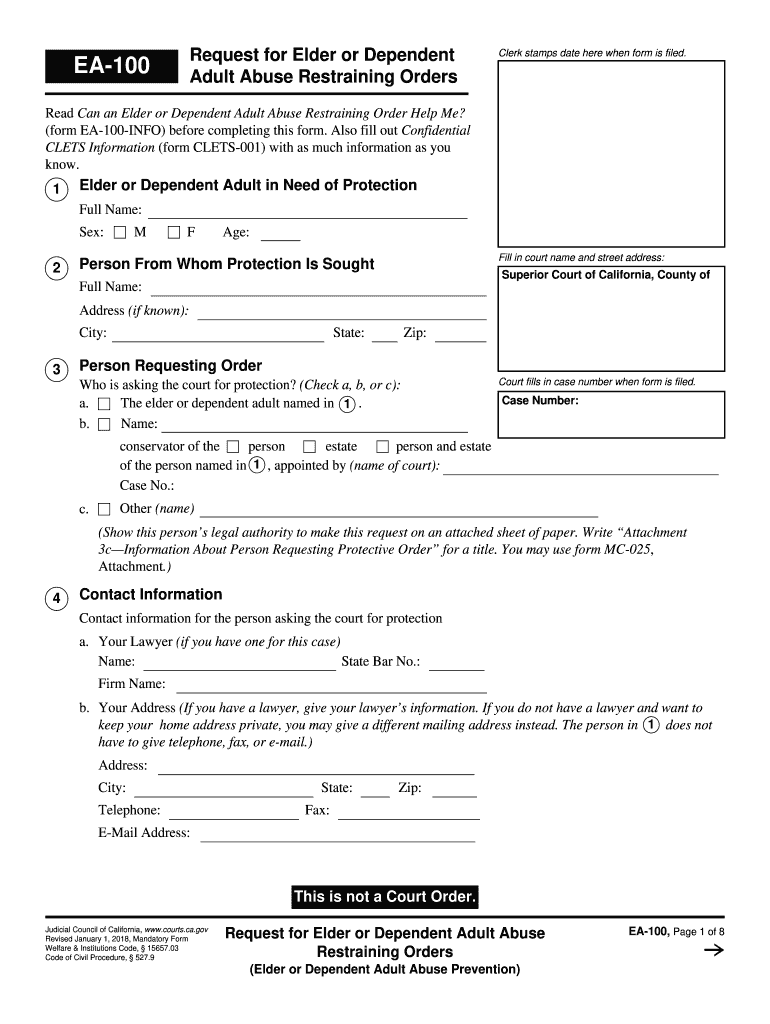

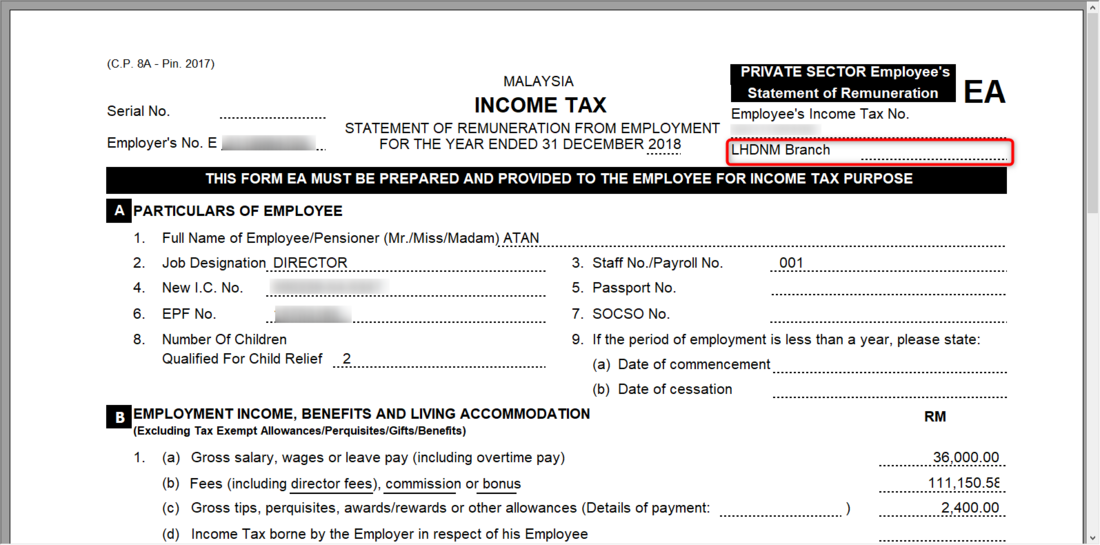

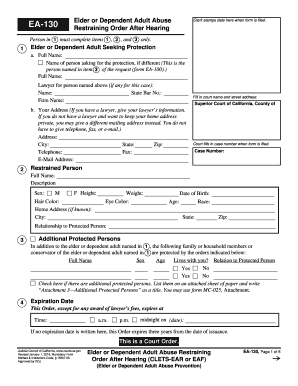

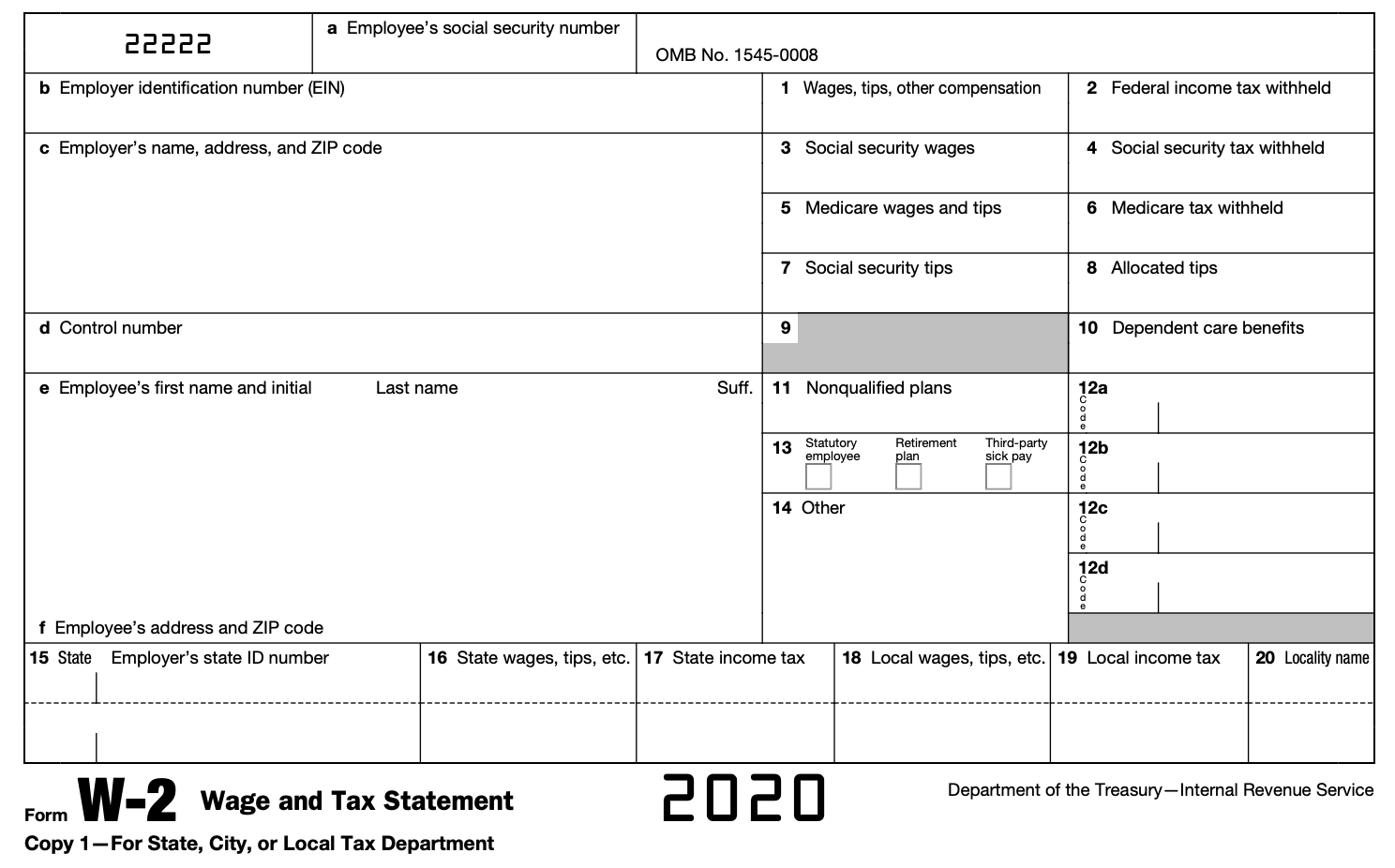

How to get ea form 2018. In the ea form 2016 many fields that were not used regularly have been removed. There have been many changes made to both the ea form 2016 and c p 8d forms. Fill up your income tax return form now that you ve gotten access to the right form let s get right down to the bottom of filling it out. 1 to 8 are required to declare in part f of form ea.

This will lead you to the main page of the the e filing system. However your game progress won t be able to cross different platforms like playstation to xbox. Choose the right form and select the year of assessment 2018 remember you are declaring your income earned for the year before. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure.

List of tax exempt allowances perquisites gifts benefits which are required to declare. Potongan daripada saraan 1994 bagi tahun berakhir 31 disember 2018 majikan dikehendaki mengisi p enyata ini untuk sem ua pekerja bagi tahun 20 18. Only tax exempt allowances perquisites gifts benefits listed above no. Notes for part f of form ea.

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. To export employee ea form you may go to payroll annual salary statement then click at the export ea form button. Go to e filing website. Enrolled agents like attorneys and certified public accountants cpas are generally unrestricted as to which taxpayers they can represent what types of tax matters they can handle and which irs offices they can represent clients before.

Generate annual ea form and e form c p 8d with one click in actpay 2020. Especially with the income tax e filing system introduced this year with a new face lift how do we go about it. There is an option that allows you to share the exported ea form with you employees easily if you don t want your employees to have access to the exported ea forms just remember to uncheck it. An enrolled agent is a person who has earned the privilege of representing taxpayers before the internal revenue service.

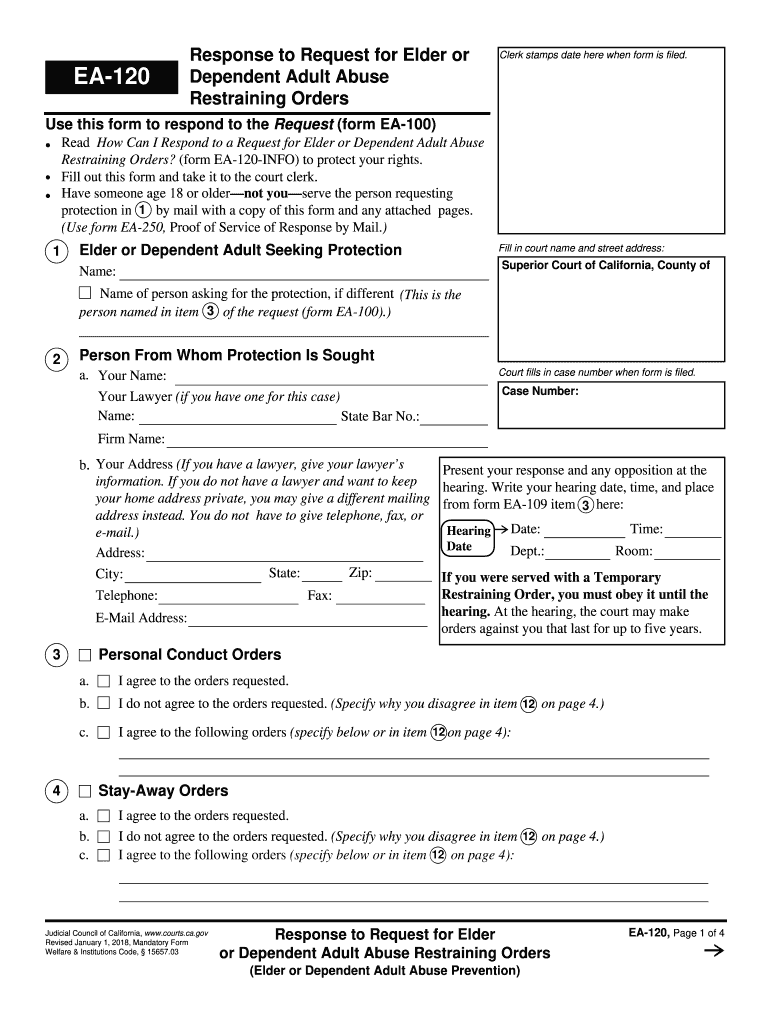

Ea this form ea must be prepared and provided to the employee for income tax purpose employment income benefits and living accommodation excluding tax exempt.