How To Get Ea Form Online Malaysia

I have 2 ea forms and when filing the returns i am adding up both the ea form total income however i could find only my first ea form tax paid reflecting in the hasil the other ea form tax paid is not reflecting which leads me to pay the tax in excess however in actual i have to get returns from the hasil.

How to get ea form online malaysia. For everyone who has no idea what ea forms are let us break it down for you. This will lead you to the main page of the the e filing system. If you ve done the above correctly you should have ea e form numbers correct. 12 2 2010 8 33 21 am.

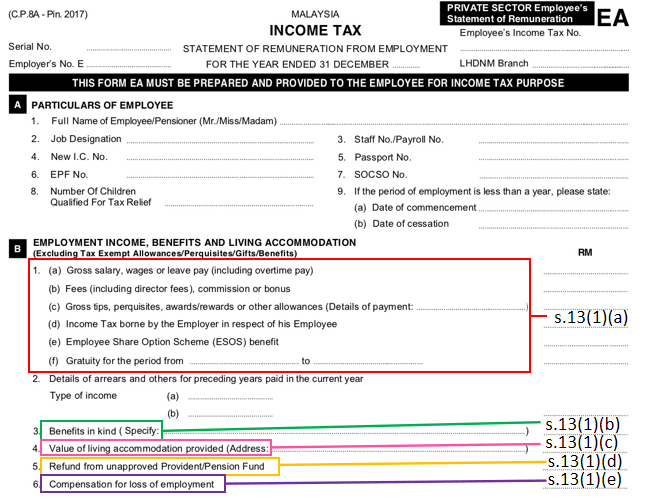

Mykad card police military card. The ea form for lembaga hasil dalam negeri lhdn or the inland revenue board of malaysia is also known as form cp8a. Ea ec 2010 notes pmd author. According to the inland revenue board of malaysia an ea form is a yearly remuneration statement that includes your salary for the past year.

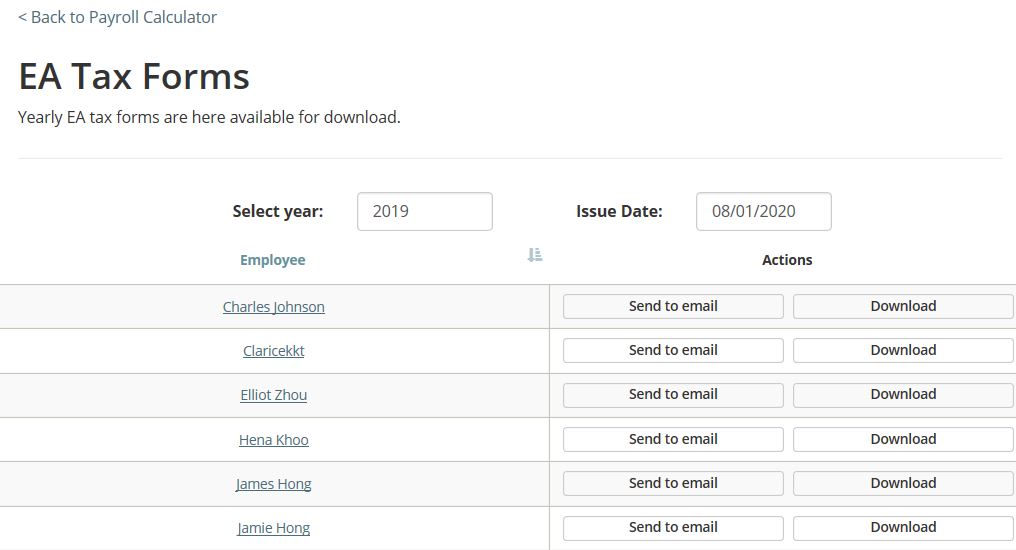

When you arrive at irb s official website look for ezhasil and click on it at the various options available on the ezhasil page choose the mytax option. Now 2019 ea form number of this person should have the numbers that you re looking for. Please note that there are 2 fields at the bottom of the ea form for name and job title of the employee who prepares the ea form. You will usually use this form to file personal taxes during tax season.

Your application number will be presented after confirmation. Malaysia income tax statement of remuneration from employment for the year ended 31 december. If you export ea form as hr my administrator these 2 fields will be left empty. Click on borang pendapatan online in the first step of e daftar and then you will have to fill up the form for registration.

Lhdn announced changes to the ea form 2016 and c p 8d forms in early 2017. Individual who are not citizens of malaysia. Go to e filing website. The application must be attached with the following documents.

After you have filled up the form you will have to reconfirm your information. It is the statement of remuneration from employment private sector. Especially with the income tax e filing system introduced this year with a new face lift how do we go about it. If you email address not registered with lhdn you have to fill up online feedback form to obtain pin number.

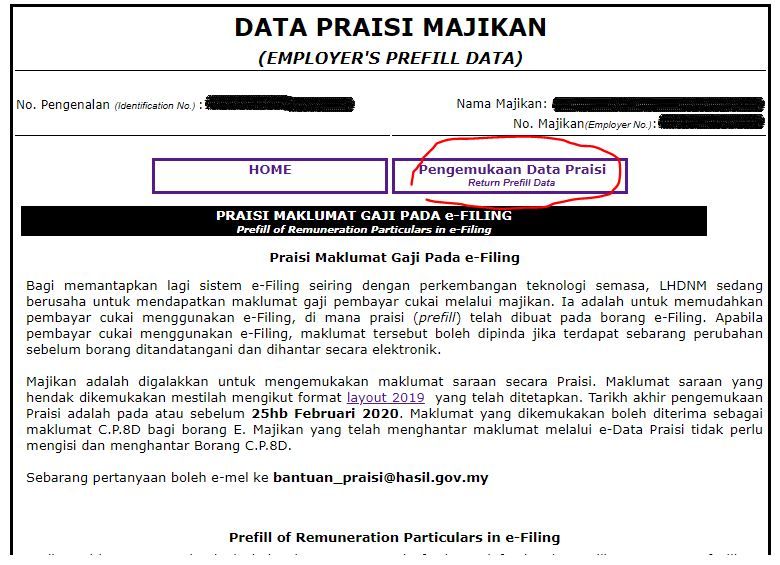

Now go to payroll form e page download the e data praisi file and unzip it. Ea this form ea must be prepared and provided to the employee for income tax purpose. By 1 mac you may skip the next step. The ea form has to be prepared by employers in malaysia and given to the employees for income tax purposes.

There have been many changes made to both the ea form 2016 and c p 8d forms. When the ea forms are shared with employees they can access it via team document form sharing in their web accounts.