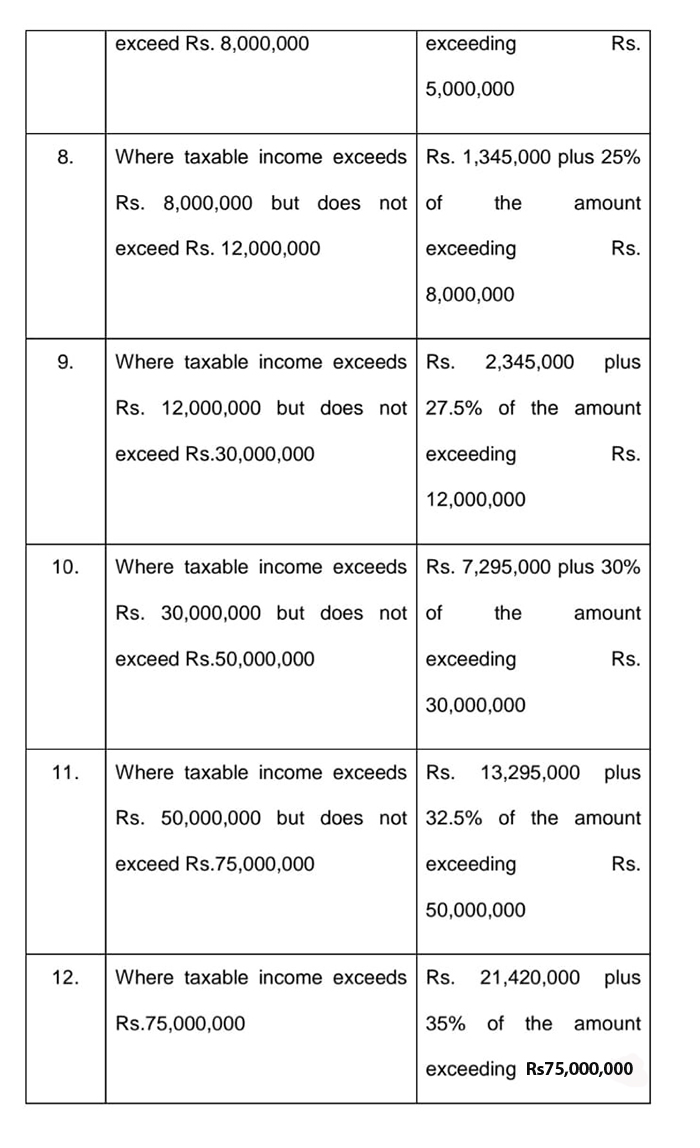

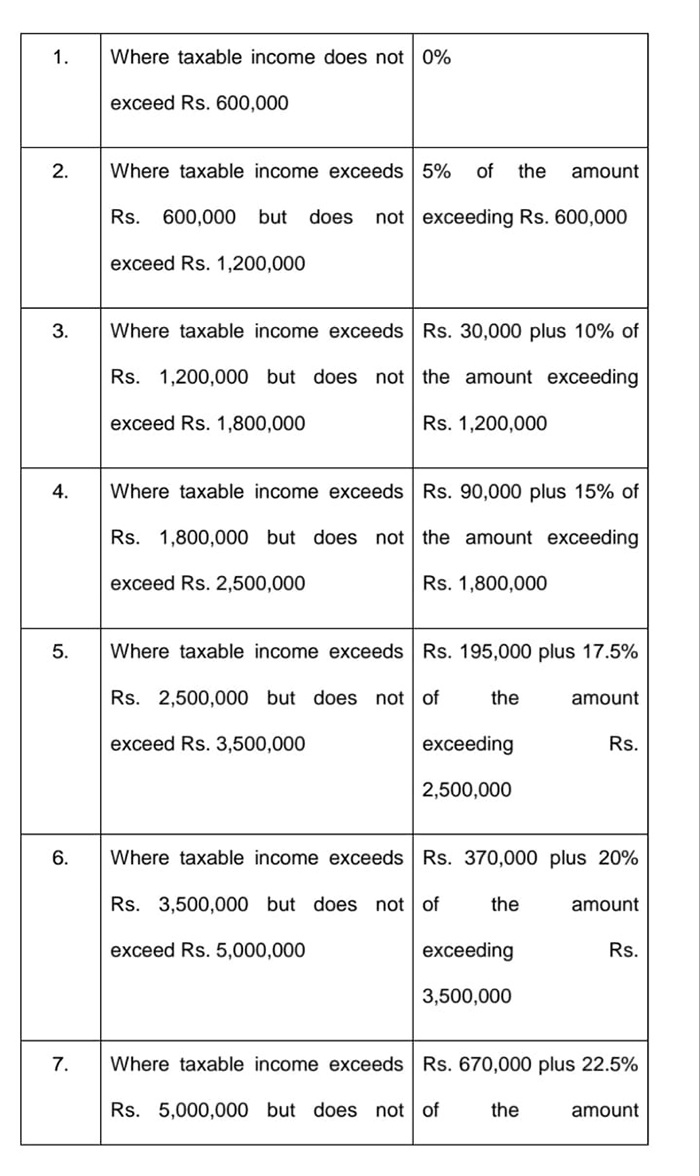

Income Tax Rate 2018 19 Pakistan

1 090 000 25 of the amount exceeding rs.

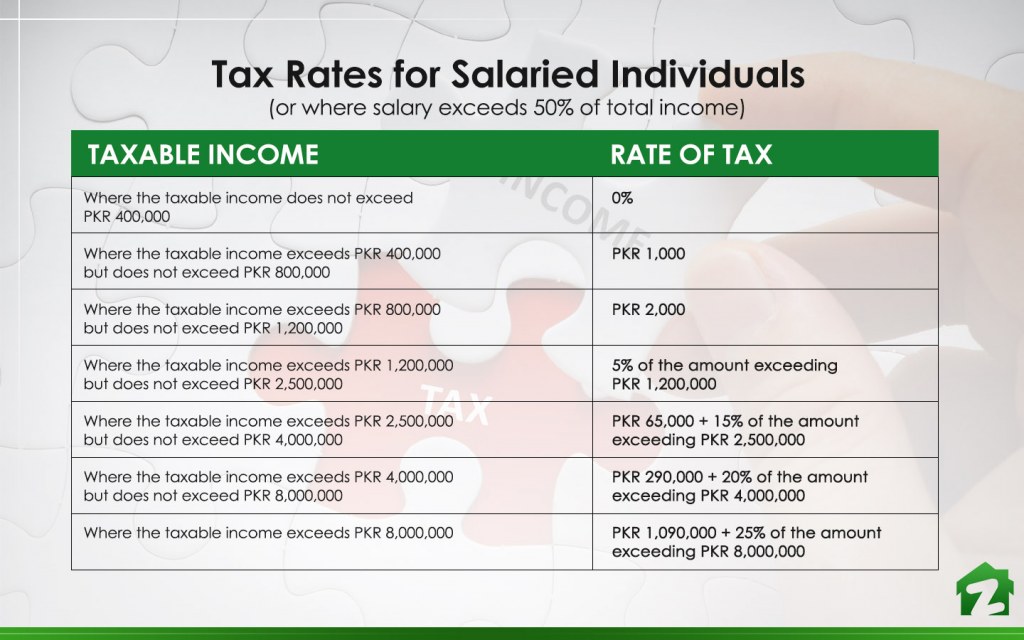

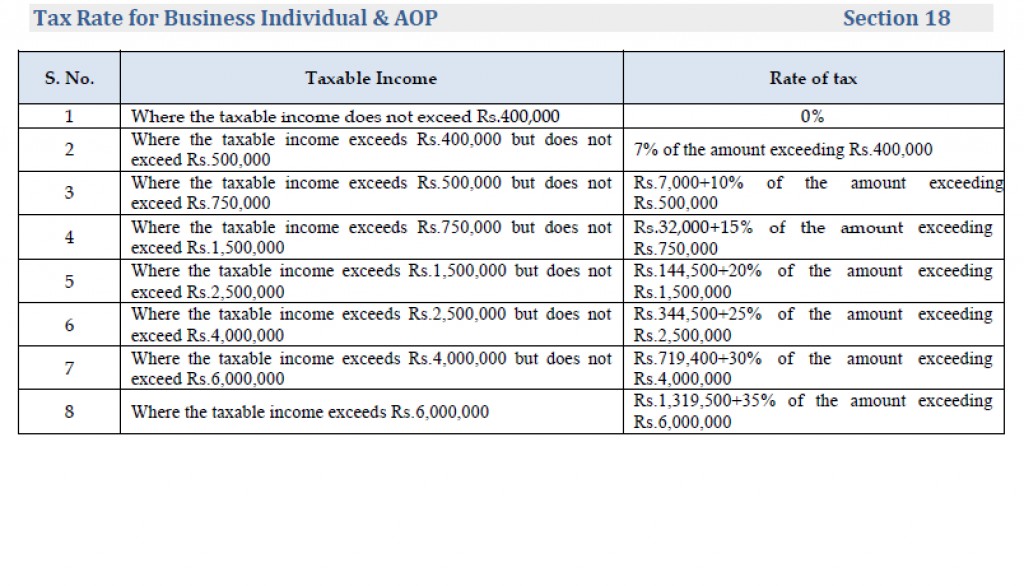

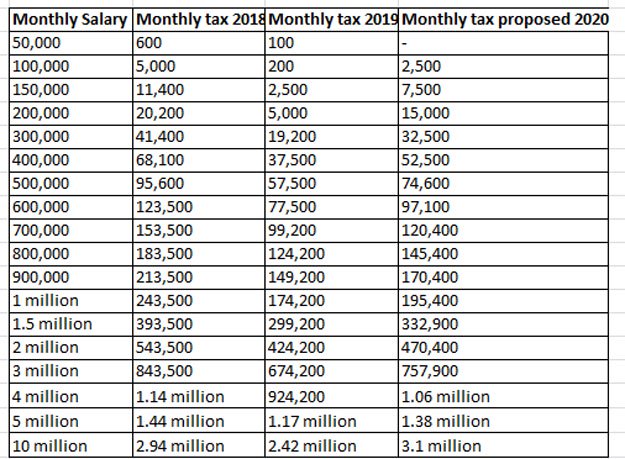

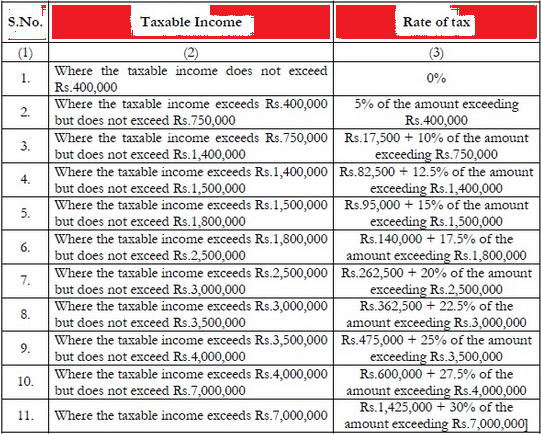

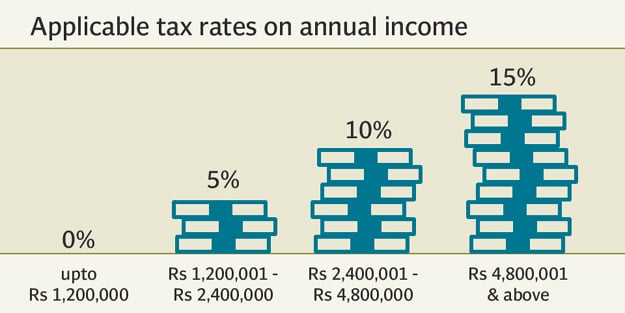

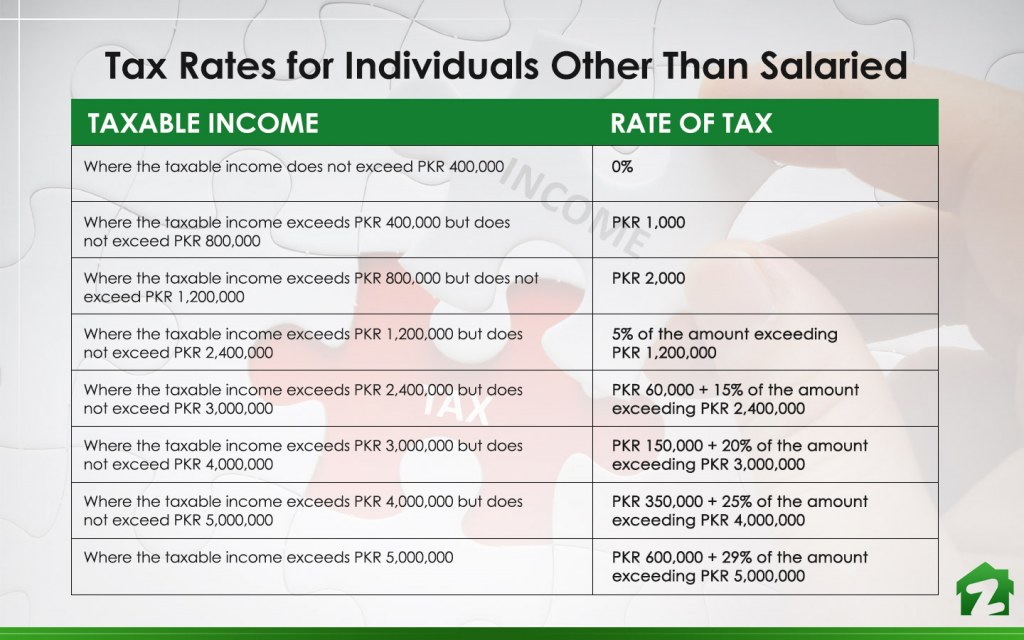

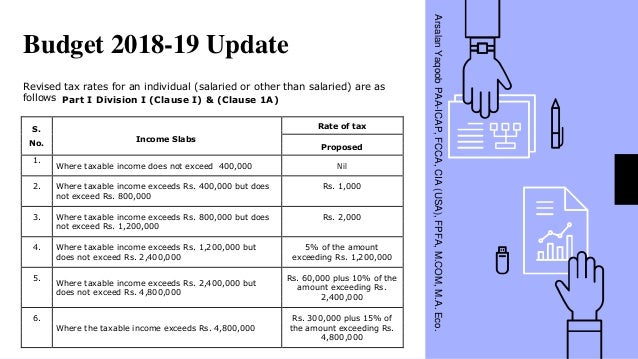

Income tax rate 2018 19 pakistan. 400 000 the rate of income tax is 0. 800 000 then the rate of income tax is rs 1000. Maximum tax rate has been reduced to 15 from 35 individuals other than salaried and 30 salaried individuals. An income tax bill of following slabs and income tax rates passed by the government of pakistan will be applicable for salaried persons for the year 2018 2019.

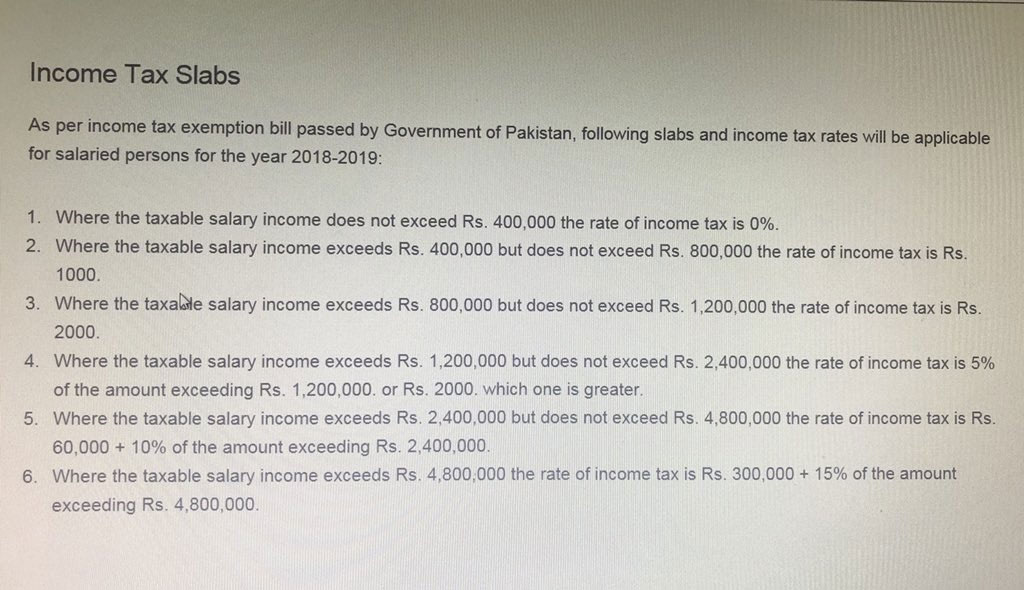

Majority of these payments do not attract enhancement of 100 even if the recipients are. As per finance supplementary amendment bill 2018 passed by government of pakistan in september 2018 following slabs and income tax rates will be applicable for. Income tax return salaried person pakistan form download we have told you regard to the fbr pakistan salary tax slabs 2017 18. Where the taxable income exceeds rs.

Pakistan budget digest 2018 19. 8 000 000 the rate of income tax is rs. This page provides pakistan personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Member of morrison ks international.

When you will earn between rs. Like if your income on a per year basis falls in the slab of pkr 400 000 and pkr 500 000 then you should be paying this income tax on an urgent basis. 400 000 then the rate of income tax is 0. Personal income tax rate in pakistan averaged 21 79 percent from 2006 until 2019 reaching an all time high of 35 percent in 2019 and a record low of 20 percent in 2007.

The personal income tax rate in pakistan stands at 35 percent. However tax rate is 25 if turnover or gross receipt of the company does not exceed rs. If your salary is rs. In general payments made on account dividend interest royalties and fee for technical services income derived from pakistan sources are subject to a 15 withholding tax wht which tax has to be withheld deducted from the gross amount paid to the recipient.

Where the taxable salary income does not exceed rs. Reduced final withholding tax rate subject to conditions as follows. Reduction in tax rates for individuals. As per income tax exemption bill passed by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018 2019.