Income Tax Rate 2018 Philippines

An individual with respect to pure compensation income as defined in section 32 a 1 derived from sources within the philippines the income tax on which has been correctly withheld tax due equals tax withheld under the provisions of section 79 of the code.

Income tax rate 2018 philippines. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. 1 corporate income tax 1 1 general information tax rate the corporate income tax rate for both resident and non resident companies is 30 except for certain items of passive income which may be taxable at a different rate. What are the current income tax rates for residents and non residents in the philippines. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

Tax rates for income subject to final tax. Income tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the tax code of 1997 tax code as amended less the deductions if any authorized for such types of income by the tax code as amended or other special laws. Taxes on director s fee consultation fees and all other income. Those earning annual incomes between p400 000 and p800.

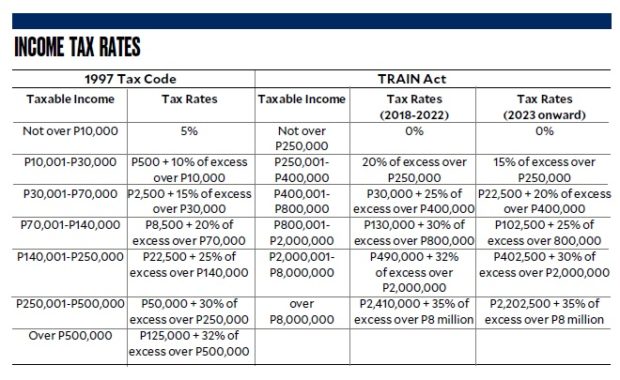

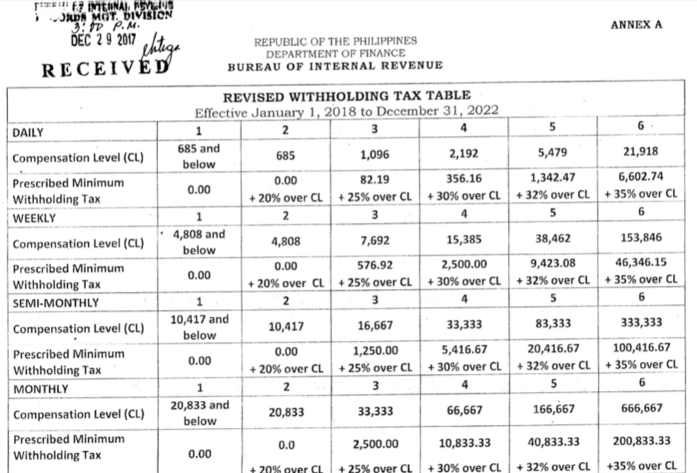

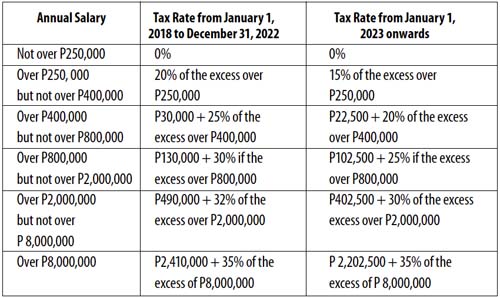

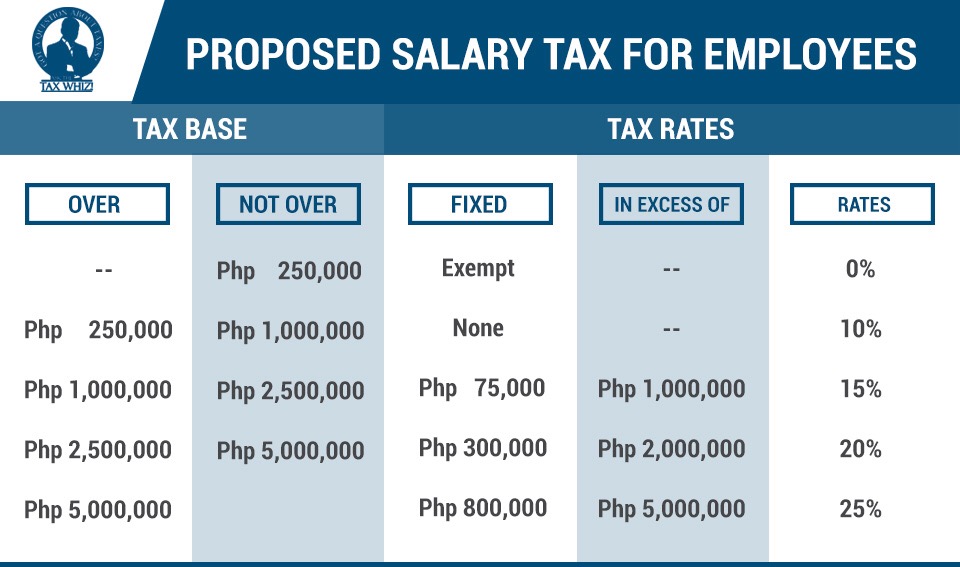

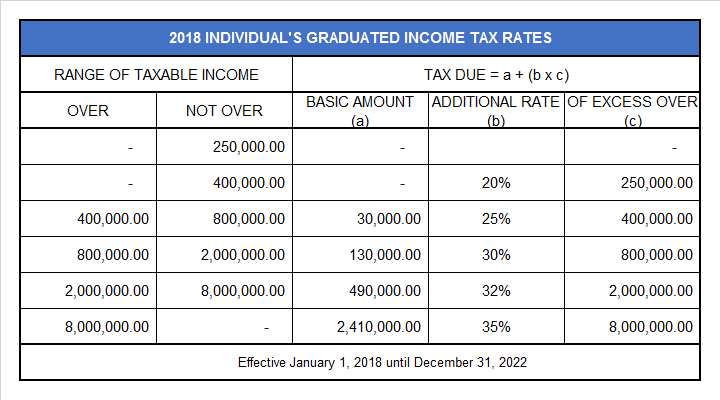

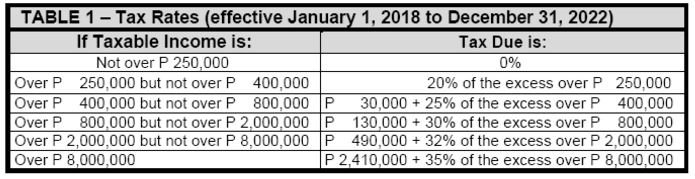

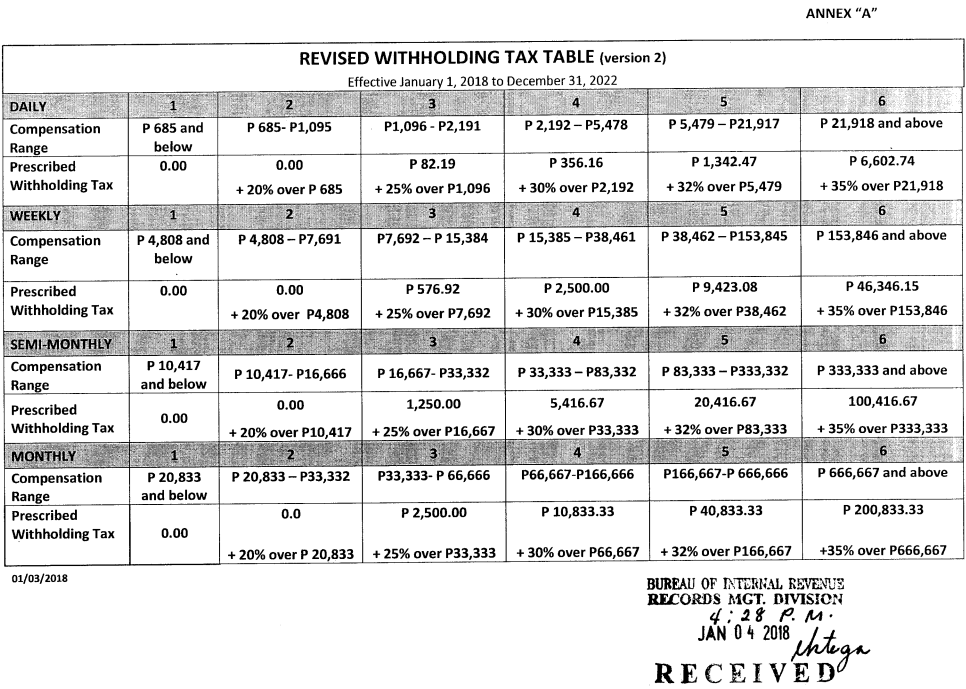

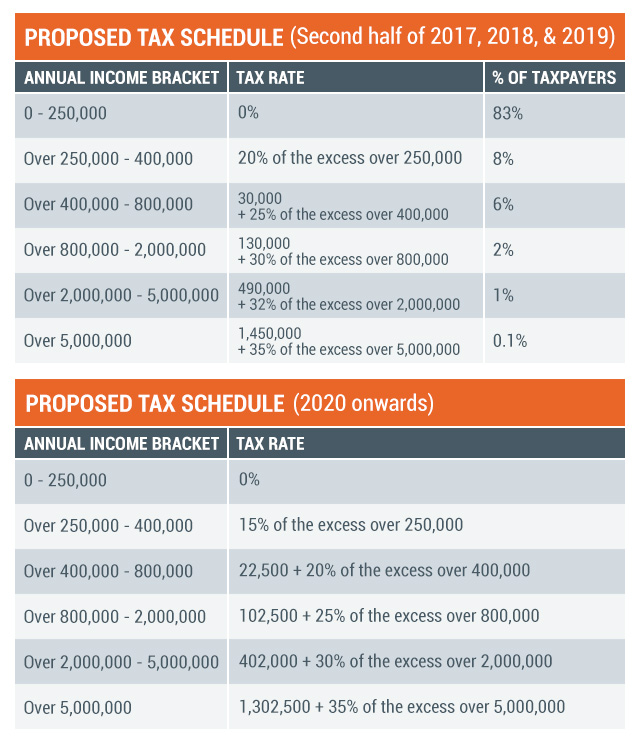

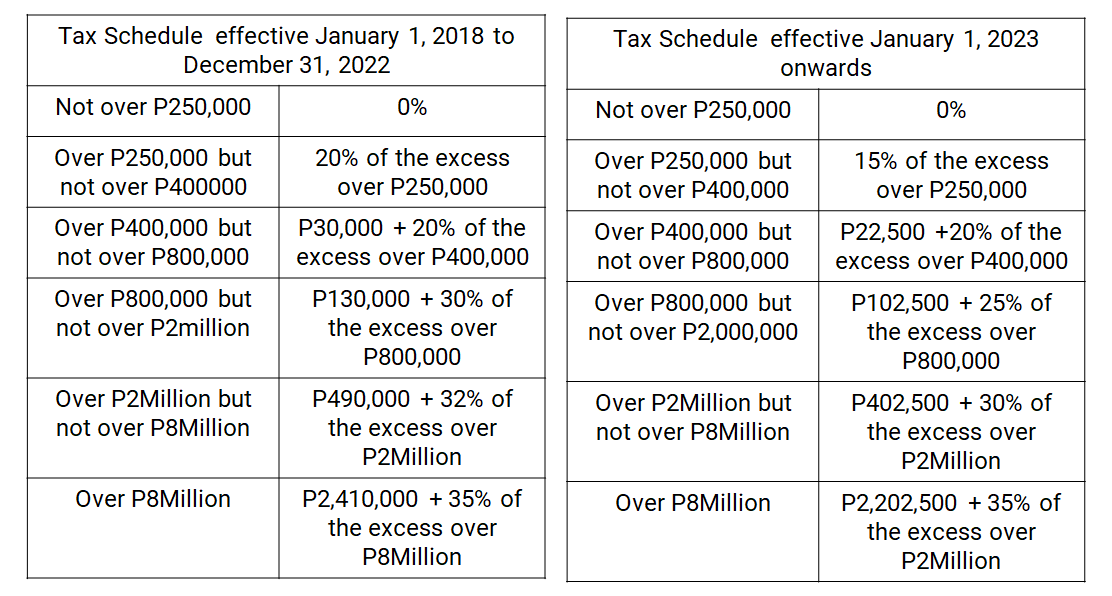

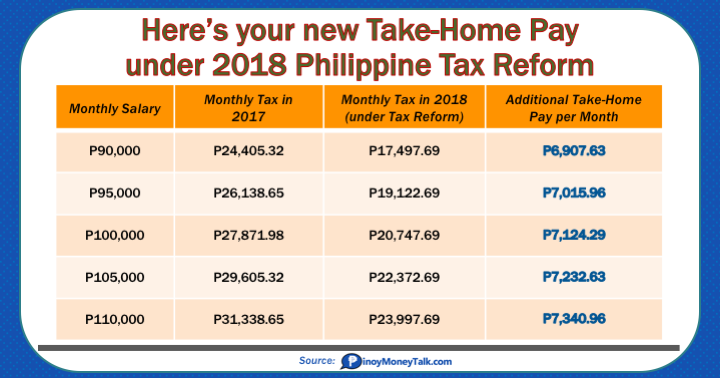

New graduated tax rates at 0 20 25 30 32 and 35 will be in effect from 1 january 2018 until 31 december 2022. In the approved tax reform bill under train from the initial implementation in the year 2018 until the year 2022. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. A comparison of the current and new tax tables is provided in the appendix.

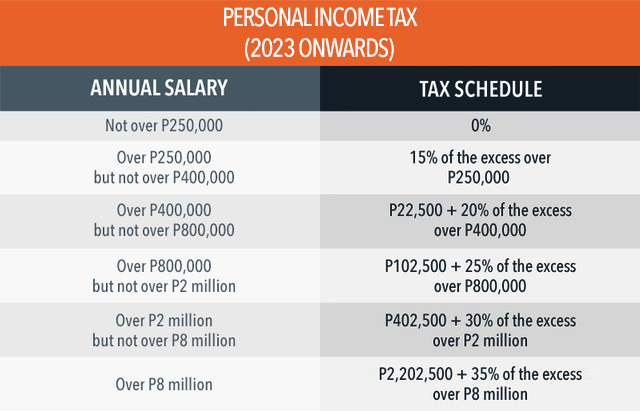

For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. New graduated tax rates will also be in effect from 1 january 2023 onwards. Personal income tax rate in philippines averaged 32 38 percent from 2004 until 2019 reaching an all time high of 35 percent in 2018 and a record low of 32 percent in 2005. The personal income tax rate in philippines stands at 35 percent.

This page provides philippines personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Income tax table for january 01 2018 to december 31 2022. Income tax rates for individuals. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000.

Provided that an individual deriving compensation concurrently from two or more employers at any time during the taxable year shall. However beginning on the 4th taxable. Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax.