Income Tax Rate 2018

Companies will be granted a 20 corporate income tax rebate capped at 10 000.

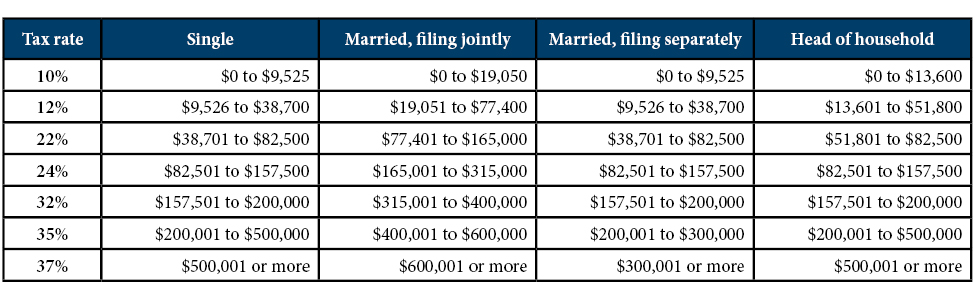

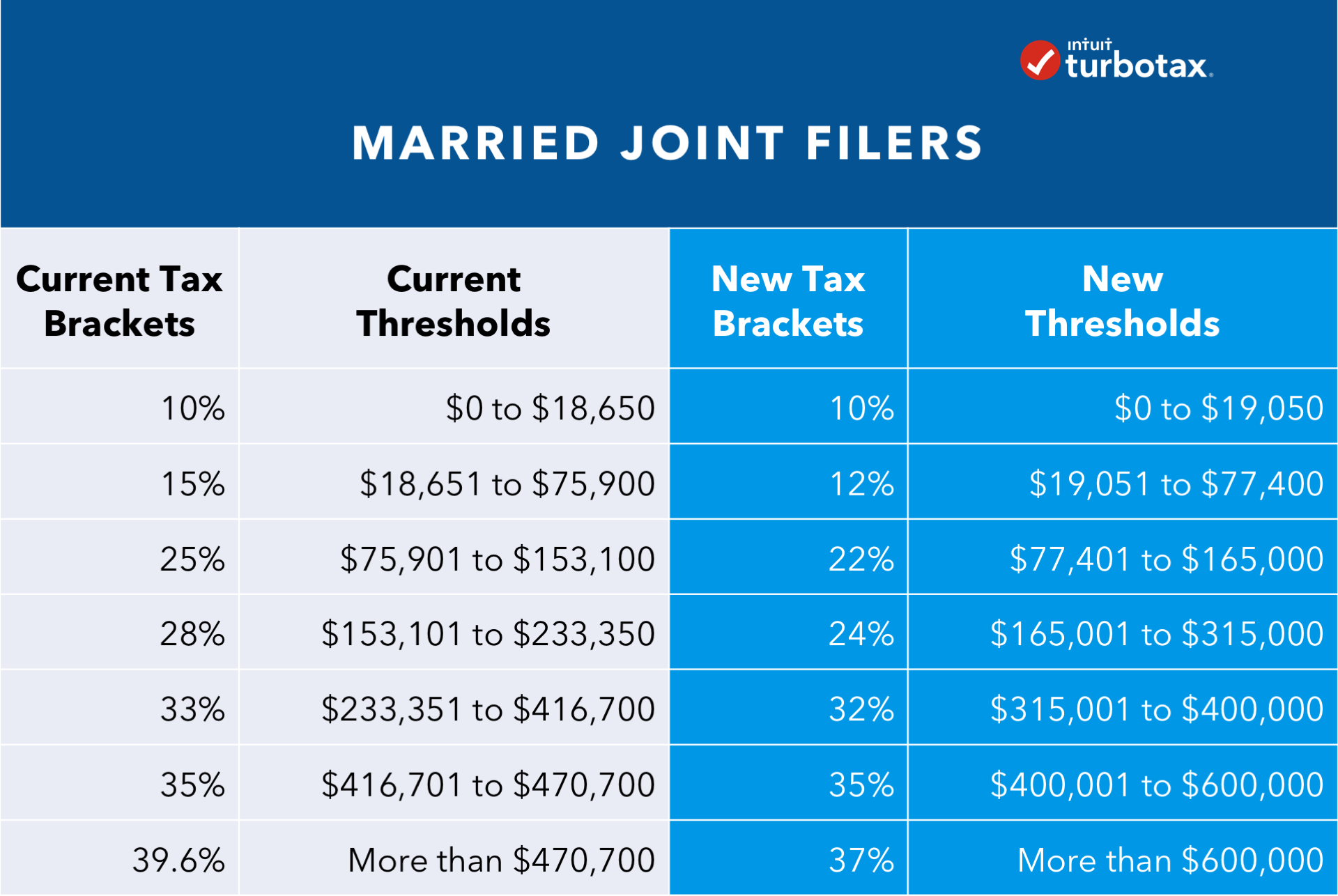

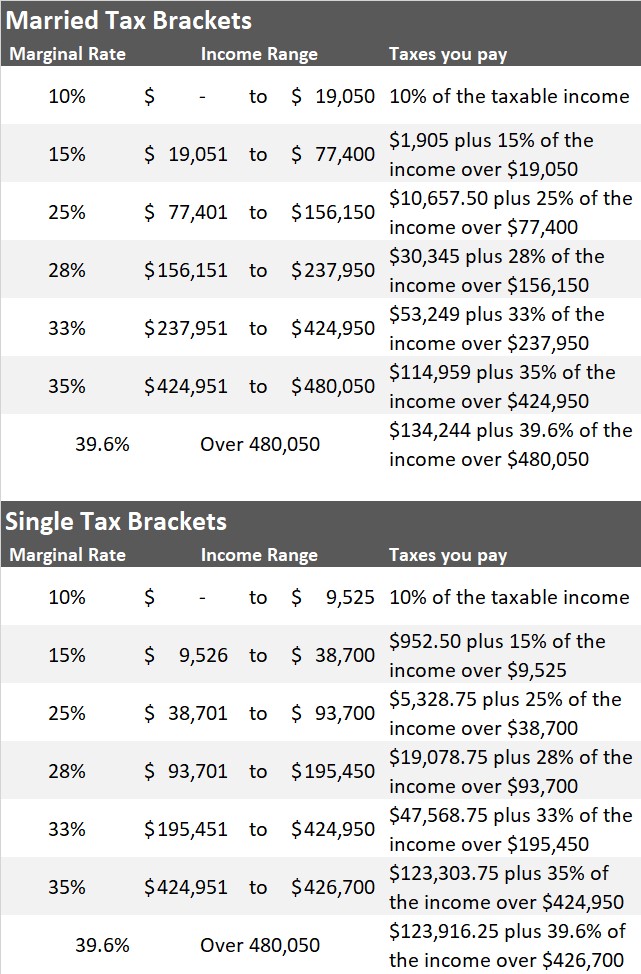

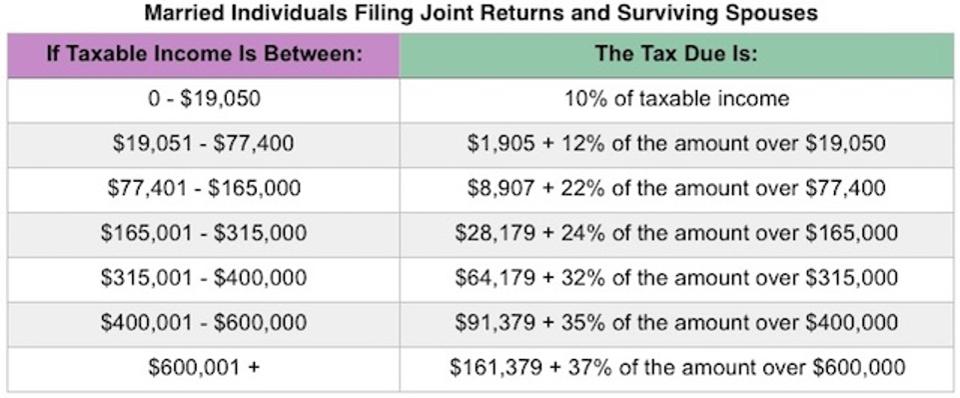

Income tax rate 2018. Resident tax rates 2020 21. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2. Companies will be granted a 50 corporate income tax rebate capped at 25 000. Income tax slab rate for ay 2018 19 for individuals.

Companies will be granted a 50 corporate income tax rebate capped at 20 000. 29 467 plus 37 cents for each 1 over 120 000. The bottom rate remains at 10 but it covers twice the amount of income compared to the previous brackets. 296 541 410 460.

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax. 1 1 individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000.

The 2017 budget made no changes to the personal income tax scale for. 410 461 555 600. Income tax brackets and rates. 18 of taxable income.

Those earning annual incomes between p400 000 and p800. Taxes on director s fee consultation fees and all other income. On the first 5 000 next 15 000. 19 cents for each 1 over 18 200.

Tax rates 2017 2018 year residents the 2018 financial year starts on 1 july 2017 and ends on 30 june 2018. Companies will be granted a 40 corporate income tax rebate capped at 15 000. 189 881 296 540. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing.

34 178 26 of taxable income above 189 880. Tax on this income. Calculations rm rate tax rm 0 5 000. 2018 tax year 1 march 2017 28 february 2018 taxable income r rates of tax r 1 189 880.

2018 standard deduction and exemptions the new tax rules also make big changes to the. 61 910 31 of taxable income above 296 540. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. 51 667 plus 45 cents for each 1 over.

5 092 plus 32 5 cents for each 1 over 45 000.