Income Tax Relief 2018 Malaysia

The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

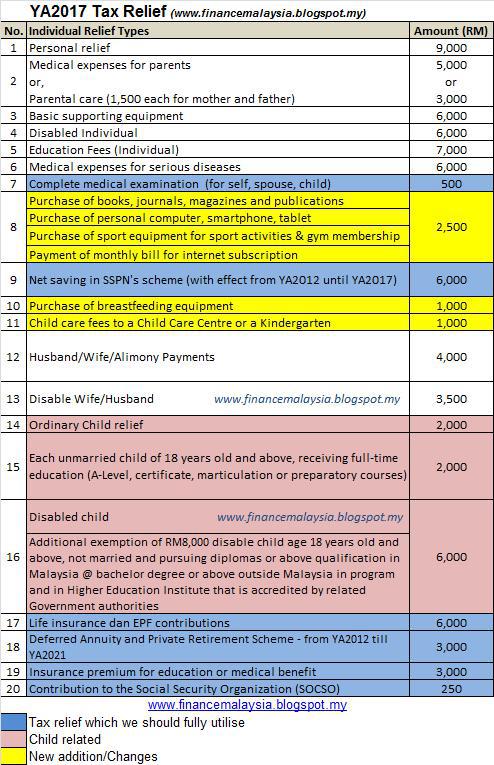

Income tax relief 2018 malaysia. There is an increase in tax payable of 797 44 900 102 56 for mrs chua from ya 2017 to ya 2018 due to the relief cap. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. Did you know that in 2016 the reading material and personal computer slash smartphone income tax relief used to have a combined worth of rm4 000.

This relief is applicable for year assessment 2013 and 2015 only. As the total amount of personal reliefs claimed by mrs chua exceeds the overall relief cap of 80 000 the total personal reliefs allowed to her is capped at 80 000 for ya 2018. Companies are not entitled to reliefs and rebates. Green technology educational services.

Reduction of the income tax rate from 18 to 17 on the first myr 500 000 of chargeable income of small and medium sized enterprises i e. Child care fees to a child care centre or a kindergarten. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

If you didn t make the most out of the lifestyle income tax relief before now is the time to do it. From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia. Companies incorporated in malaysia with paid up capital or limited liability partnerships resident in malaysia with a total capital contribution of myr 2 5 million or less and that are not part of a group containing an entity exceeding this capitalization. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

Personal tax reliefs in malaysia. If planned properly.