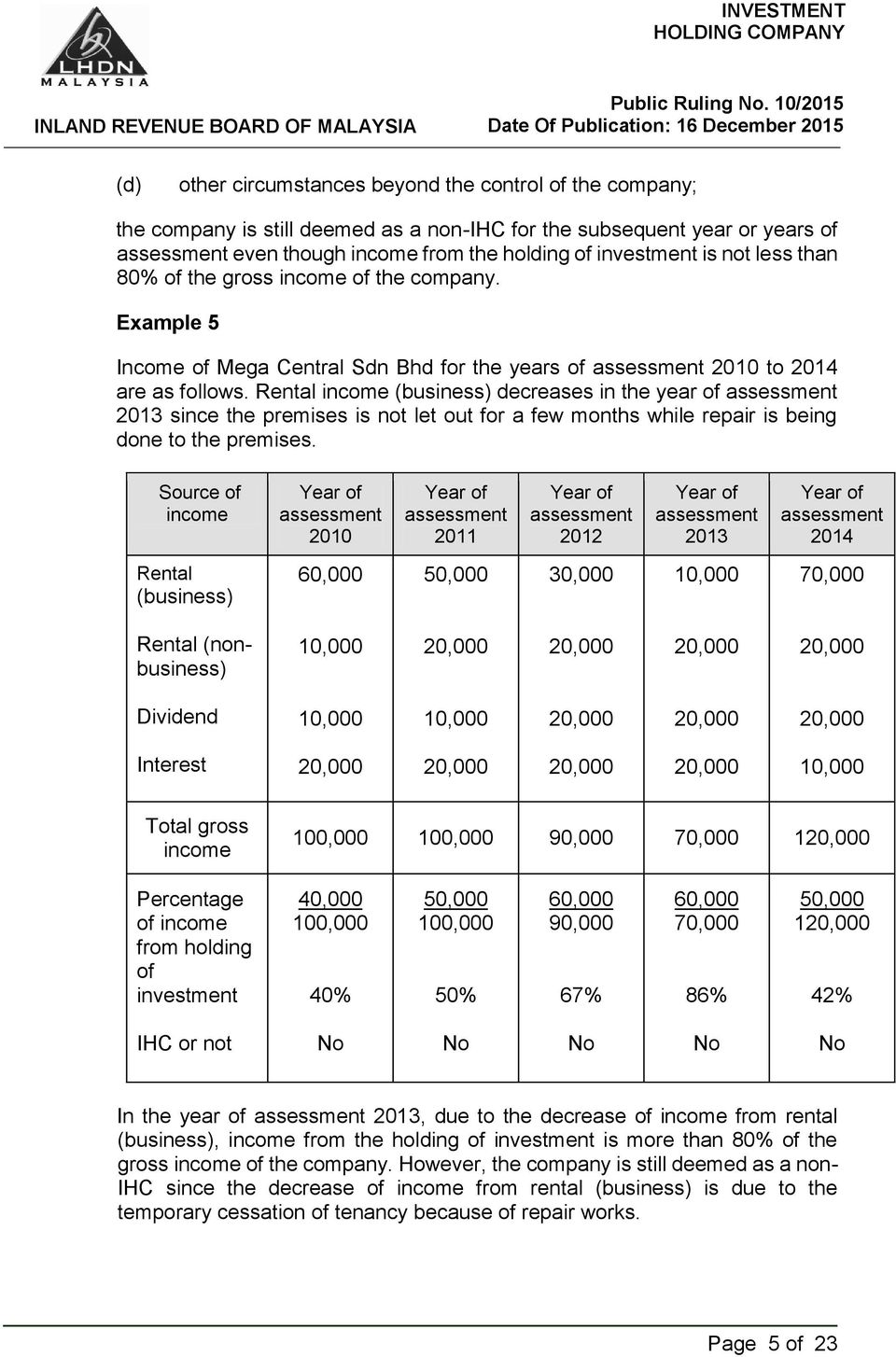

Investment Holding Company Malaysia Tax Rate 2020

Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

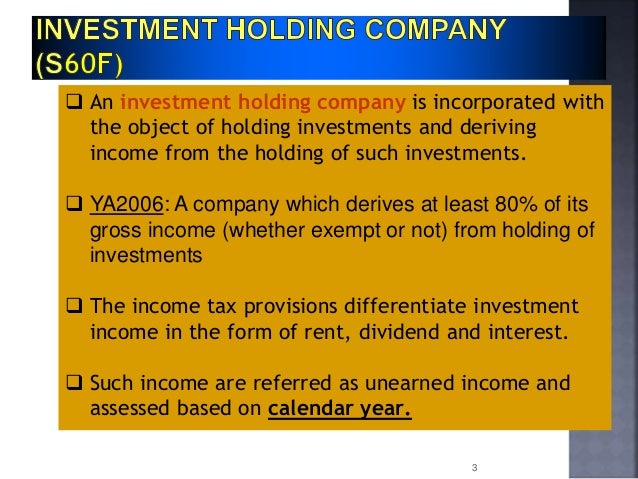

Investment holding company malaysia tax rate 2020. 1967 a company which is an investment holding listed on bursa malaysia is deemed to have gross income from a business source and is eligible for tax treatment under paragraphs 2a or 2d part 1 schedule 1 and subparagraph 19a 3 schedule 3 of ita 1967. Company llp have no business income including those temporary closed but with other income which is not taxed under paragraph 4 a ita is not eligible for above special tax treatment and taxed at 24. Resident company other than company described below 24. This page is also available in.

Unlisted investment holding company ihc taxed under section 60f is deemed to have no business income and it is not eligible for above special tax treatment and taxed at 24. Investors interested in company formation in malaysia should become familiar with the provisions of the companies act 1965 the main rule of law for commercial companies operating on this market. Equity holding company in recognition of the difficulties of holding companies in achieving the substantial activity requirements of 2 fte and rm50 000 operating expenditure under the labuan business activity tax requirements for labuan business activity regulations 2018 refer to taxavvy 3 2020. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

It controls the board of directors it owns more than 50 of the voting. Holding company regime an investment holding company ihc is a company whose activities consist. International tax malaysia highlights 2020 updated january 2020. Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate.

2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Company llp which does not have gross income from business sources but have other. That does not control directly or indirectly another company that has paid up capital of. Cit rate for year of assessment 2019 2020.

According to the section 5 of the companies act a business is considered a holding company if it has the following rights.