Investment Holding Company Malaysia Tax Rate

16 december 2015 page 1 of 23 1.

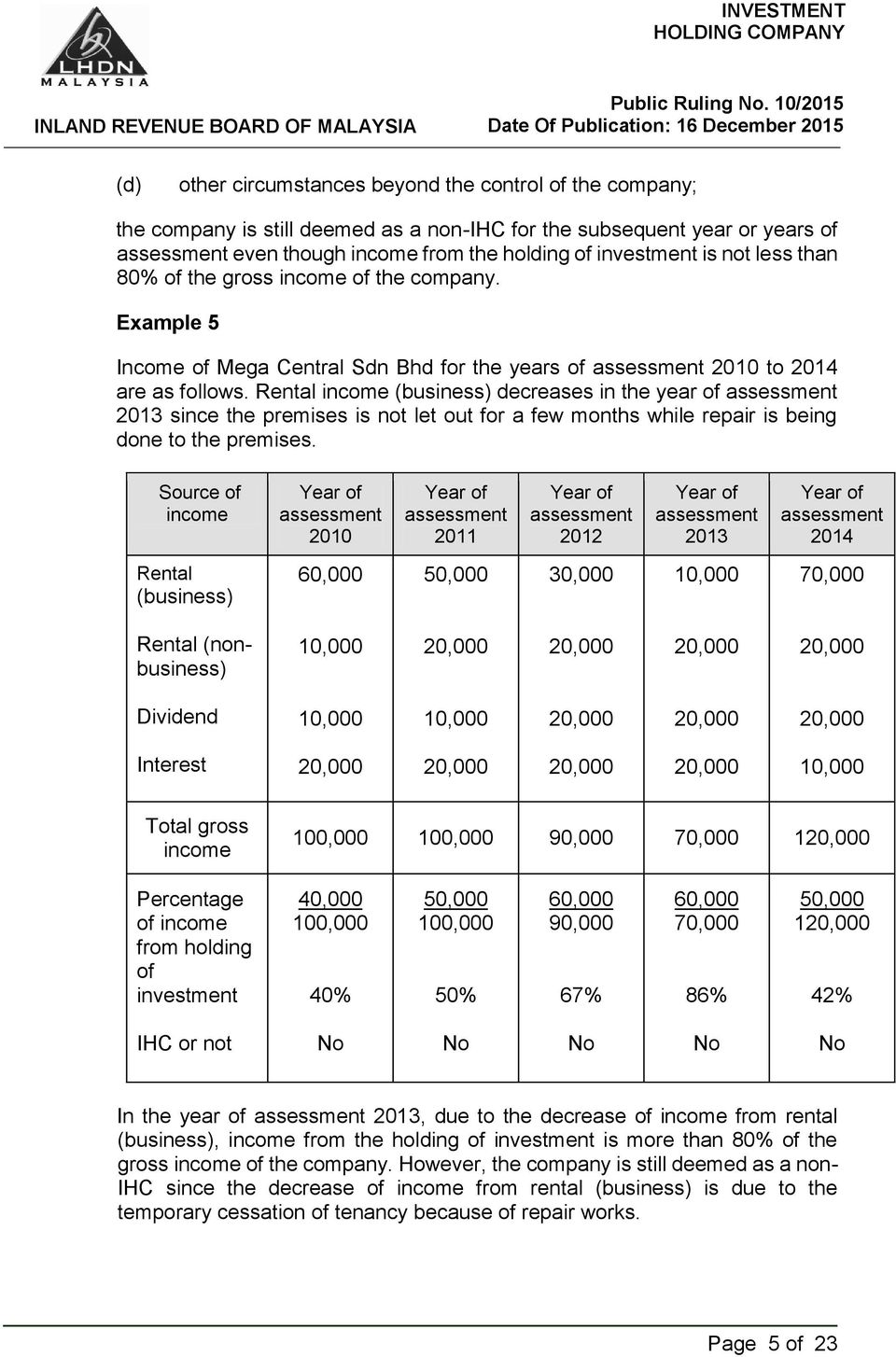

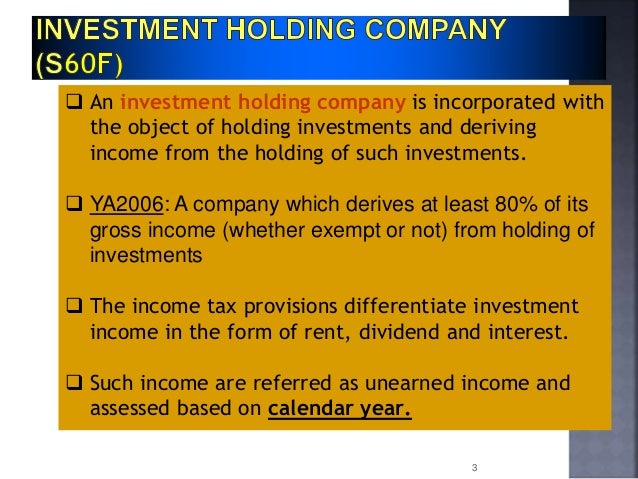

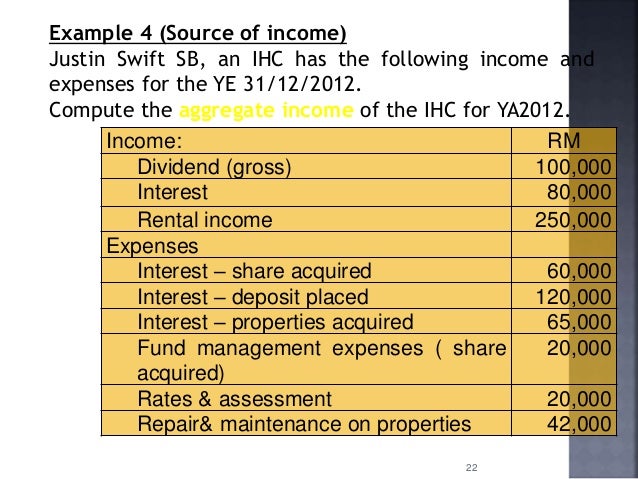

Investment holding company malaysia tax rate. The current cit rates are provided in the following table. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. Company llp have no business income including those temporary closed but with other income which is not taxed under paragraph 4 a ita is not eligible for above special tax treatment and taxed at 24. Unlisted investment holding company ihc taxed under section 60f is deemed to have no business income and it is not eligible for above special tax treatment and taxed at 24.

For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Investment holding companies will still be eligible for partial tax exemption. For existing companies including existing companies with approved operational. If a company is listed on the malaysian stock exchange they will be regulated under the income tax act section 60 fa.

Chargeable income myr cit rate for year of assessment 2019 2020. Inland revenue board of malaysia investment holding company 10 2015 date of publication. Investment holding company tax rate. The tax requirements for an investment holding company in malaysia will depend on whether the company in question is listed on bursa malaysia.

For resident company with paid up capital of rm2 5 million and below at the beginning of the basis period the tax rate for first rm500 000 chargeable income is 19 reduced to 18 in ya 2017. Objective the objective of this public ruling pr is to explain the tax treatment in respect of an investment holding company resident in malaysia. Tax requirements for investment holding companies in malaysia. Back to archive investment holding company tax rate.

Relevant provisions of the law. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e companies incorporated in malaysia with paid up capital of myr 2 5 million or less that are not part of a group containing a company exceeding this capitalization threshold and that have gross. For details please refer to corporate tax rates corporate income tax rebates and tax exemption schemes. What are the main activities of an investment holding company in malaysia.