Investment Holding Company Malaysia Tax

Inland revenue board of malaysia investment holding company 10 2015 date of publication.

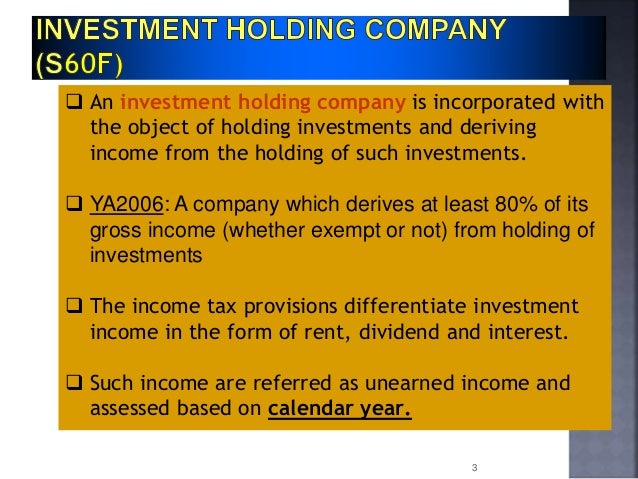

Investment holding company malaysia tax. 16 december 2015 page 1 of 23 1. Tax requirements for investment holding companies in malaysia. Unlisted investment holding company ihc taxed under section 60f is deemed to have no business income and it is not eligible for above special tax treatment and taxed at 24. Objective the objective of this public ruling pr is to explain the tax treatment in respect of an investment holding company resident in malaysia.

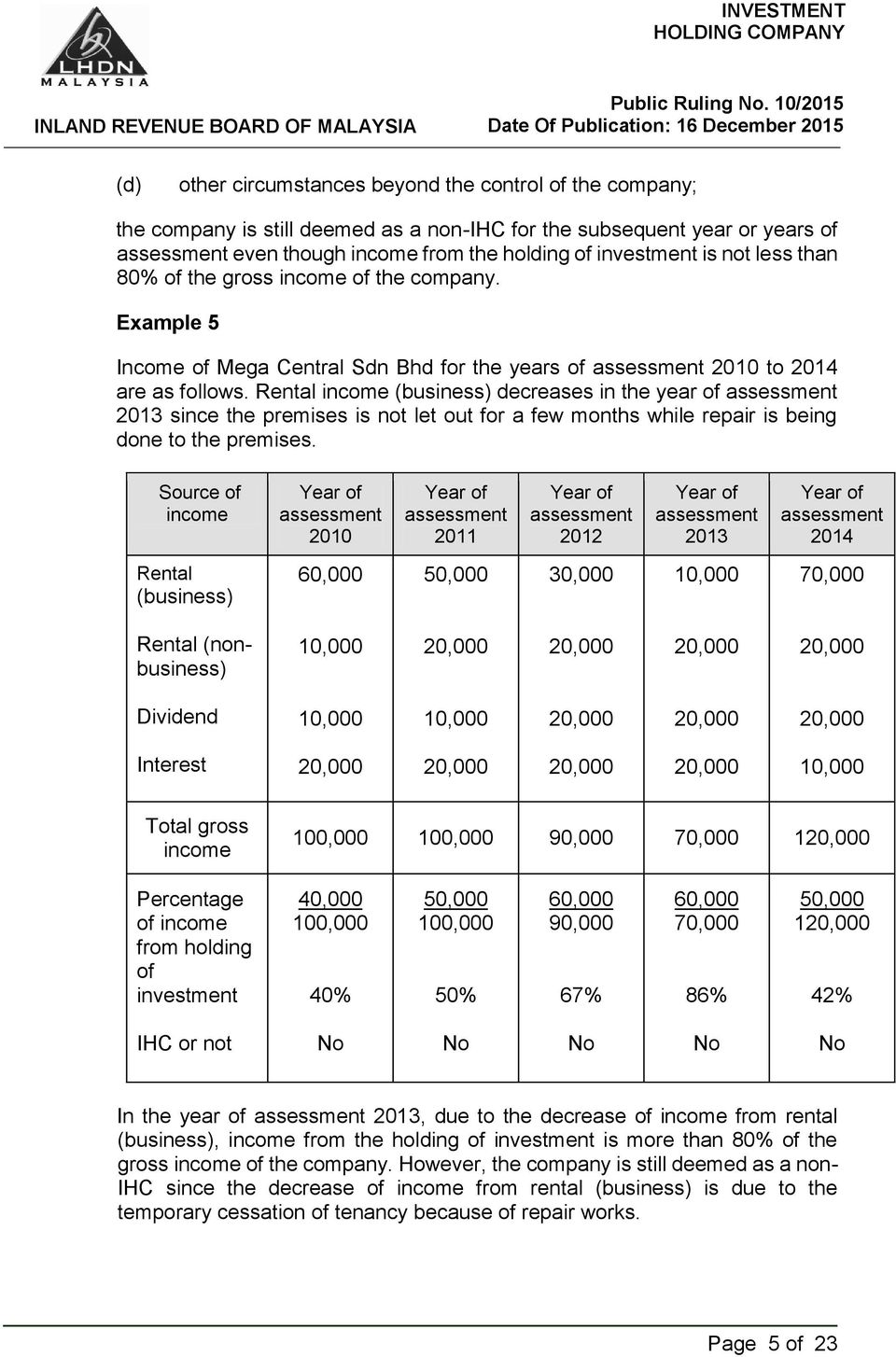

If a company is listed on the malaysian stock exchange they will be regulated under the income tax act section 60 fa. Company llp have no business income including those temporary closed but with other income which is not taxed under paragraph 4 a ita is not eligible for above special tax treatment and taxed at 24. An investment holding company ihc means a company whose activities consist mainly in the holding of investments and not less than 80 of its gross income other than gross income from a source consisting of a business of holding of an investment whether exempt or not is derived from the holding of those investments. Determination of an investment holding company 2 8 7.

The tax requirements for an investment holding company in malaysia will depend on whether the company in question is listed on bursa malaysia. Tax treatment for investment holding company listed 15 25 on the bursa malaysia 10. Relevant provisions of the law. Resident company other than company described below 24.

These proposals will not become law until their enactment and may be amended in the course of their passage through. A company whose activity consists mainly in the holding of investment properties and derives rental income may fall into the definition of investment holding company pursuant to section 60f of the income tax act 1967. If a company derives 80 of the gross investment from other legal investments it can be considered as the investment holding company. What are the main activities of an investment holding company in malaysia.

With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. An investment holding company in malaysia defines a type of holding company which has as a basic activity the holding of investments in other legal entities in order to qualify as an investment holding company at least 80 of the company s gross income has to derive from such investments. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. These types of holding company in malaysia are allowed to develop a particular type of business activities.

Tax treatment for investment holding company 8 8 tax treatment for investment holding company not listed 8 15 on the bursa malaysia 9. An investment holding company is one which has been incorporated with the object of holding investments and to derive income.