Monthly Tax Deduction Malaysia 2019

Mtd as final tax starting from malaysia income tax year of assessment 2014 tax filed in 2015 taxpayers who have been subjected to mtd are not required to file income tax returns if such monthly tax deductions constitute their final tax.

Monthly tax deduction malaysia 2019. Therefore these monthly deductions are net of personal relief relief for spouse with no income child relief and zakat payments. Monthly tax deduction mtd or pcb potongan cukai bulanan was introduced in january 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the pcb deduction schedule. Current position currently an individual income taxpayer is eligible to claim income tax relief on contributions made to. Within 1 year after the end of the year the payment of withholding tax is made.

What is income tax return. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. With a separate assessment both husband.

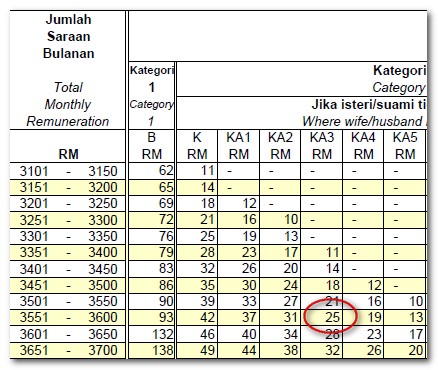

Employer s responsibilities under the monthly tax deduction mtd rules are as follows. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. Calculation method of monthly tax deduction mtd 2019 are as follows. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

2018 2019 malaysian tax booklet income tax. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. What is tax rebate. Review of income tax relief on contribution to an approved provident fund or takaful or life insurance premiums.

Deduct the mtd from the remuneration of employee in each month or the relevant month in accordance with the schedule of monthly tax deductions or computerised calculation method and pay to the director general. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. Payment of monthly bill for internet subscription under own name 2 500 restricted 9. All married couples have the option of filing individually or jointly.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Purchase of breastfeeding equipment for own use for a child aged 2 years and below deduction allowed once in every 2 years of assessment 1 000 restricted 10. What is a tax deduction. Posted on december 16 2019 december 16 2019 by info monthly tax deduction mtd or pcb potongan cukai bulanan was introduced in january 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the pcb deduction schedule.