Monthly Tax Deduction Malaysia Calculation

Mtd as final tax starting from malaysia income tax year of assessment 2014 tax filed in 2015 taxpayers who have been subjected to mtd are not required to file income tax returns if such monthly tax deductions constitute their final tax.

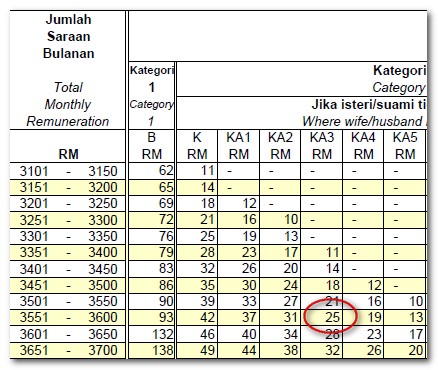

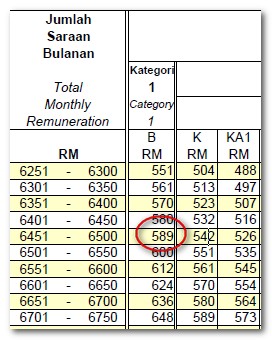

Monthly tax deduction malaysia calculation. There are two ways to calculate pcb through a computerised method or a non computerised calculation. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. 7 minutes so you ve read our introduction to monthly tax deductions mtd pcb and have an understanding of what it is why it exists whether you need to file it and how it works. Monthly tax deduction mtd for computerised calculation the mtd calculation depends on the residence status of the employee.

With a separate assessment both husband. Monthly tax deduction mtd or pcb potongan cukai bulanan was introduced in january 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the pcb deduction schedule. The calculator is designed to be used online with mobile desktop and tablet devices. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. All married couples have the option of filing individually or jointly. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. Non resident employee mtd of an employee who is not resident or not known to be resident in malaysia shall be calculated at the rate of 30 of his remuneration. Therefore these monthly deductions are net of personal relief relief for spouse with no income child relief and zakat payments. The monthly wage calculator is updated with the latest income tax rates in malaysia for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income.

If you do need to file it then you must know how to calculate it. There are 2 types of residence status as follows. How does monthly tax deduction mtd pcb work in malaysia. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month.