Submit Income Tax Malaysia

Subscribe to mypf youtube q1.

Submit income tax malaysia. By prescribed form cp204. Once you have gotten your pin here are the steps on how to file income tax in malaysia. Many of them thought we don t need to pay tax in malaysia since we have paid tax in singapore. Many friends of mine don t submit income report since they worked in singapore.

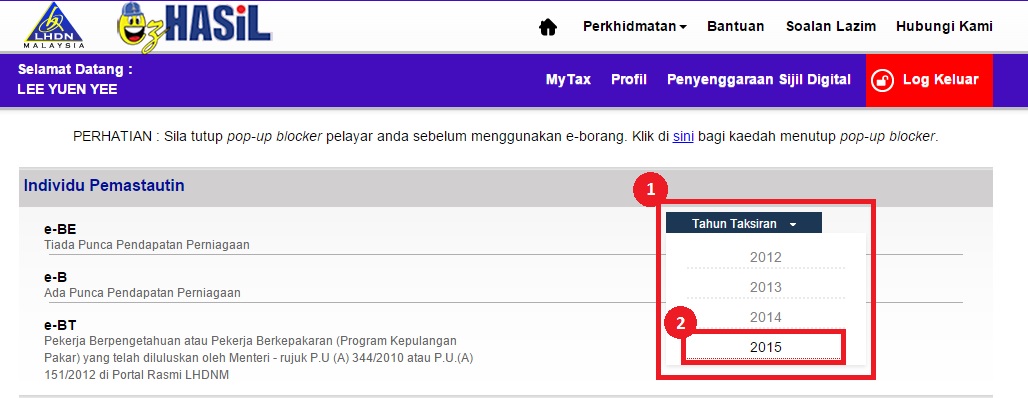

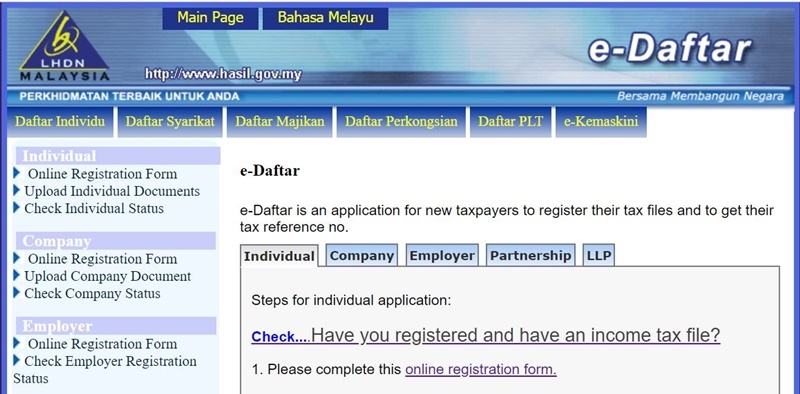

Lhdn s official website http www hasil gov my click on ezhasil https ez hasil gov my and then click on mytax. The prescribed form for initial submission is form cp204 and for revision of the initial submission is form cp204a. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

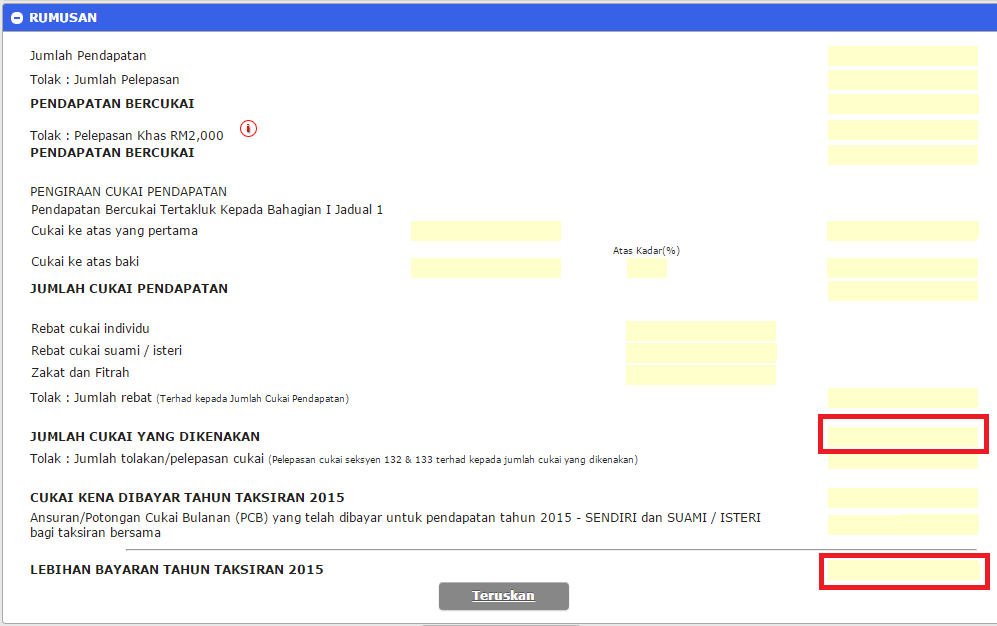

But if malaysia has effective double taxation agreement with singapore. Refer to the message posted about who work in china i am bound to submit income tax report right. However i just realize that for ya2019 jan dec 2018 i also need to pay tax to malaysia even thought i work in singapore because got extra income which i earned thru organizing activities in oversea but payment done by malaysia company to my malaysia bank account. You just need to enter your income deduction relief and rebate only.

6 commonly asked questions with regards to personal income tax e filing for first time tax payers. Adalah dimaklumkan bahawa lembaga hasil dalam negeri malaysia lhdnm akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem lhdnm. Ezhasil e filing is a most convenient way to submit income tax return form itrf. Submission of tax estimate in malaysia is mandatory under section 107c of the malaysian income tax act 1967.

Individual without business income. Sehubungan itu keseluruhan rangkaian sistem lhdnm meliputi ezhasil bantuan sara hidup dan bantuan prihatin nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. You must pay income tax on all types of income including income from your business or profession employment.

Taxpayers can start submitting their income tax 2019 return forms through the e filing malaysia 2019 system starting from march 1 of every year unless otherwise announced by lhdn. What is defined as income. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. How to submit the estimate of tax payable.

Go to e filing website.