What Is Form 49

Why issue a c form to seller what is form no 49.

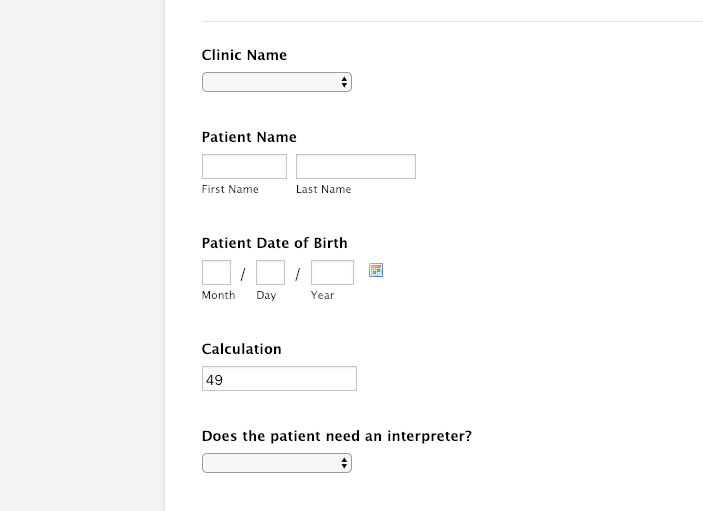

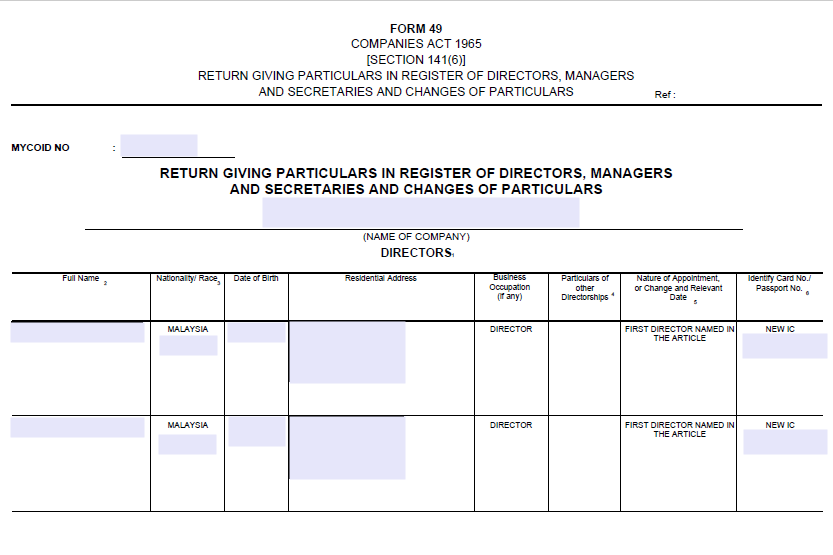

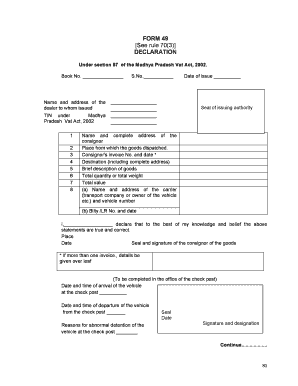

What is form 49. Changes of particulars are also made in form 49. This form is mandatory for obtaining the 10 digit permanent account number pan. Convert to radical form 49 1 2 if is a positive integer that is greater than and is a real number or a factor then. Form 49 return giving particulars in register of directors managers and secretaries and changes of particulars.

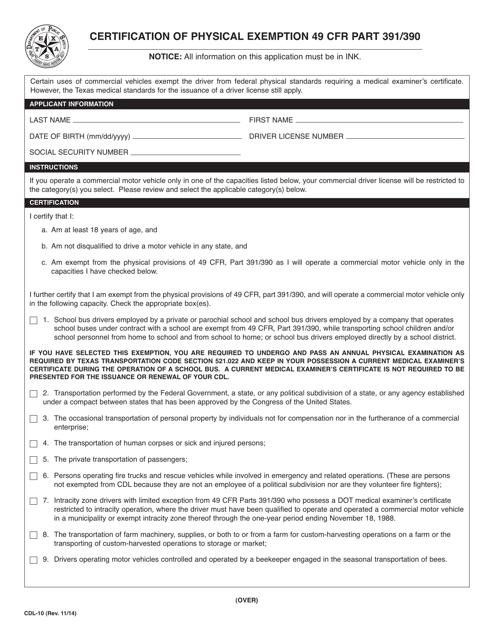

Notification of change in the register of directors managers and secretaries. Pan form 49 a is designed for the use of indian citizens entities incorporated in india unincorporated entities formed in india and indian companies. The registered dealer only issue form c to reduce the sales tax i e. Use the rule to convert to a radical where and.

Annual return of company not having share. Answer dhiraj singh. 1 what is form 49 aa. And form 49 a is use in apply for pan card.

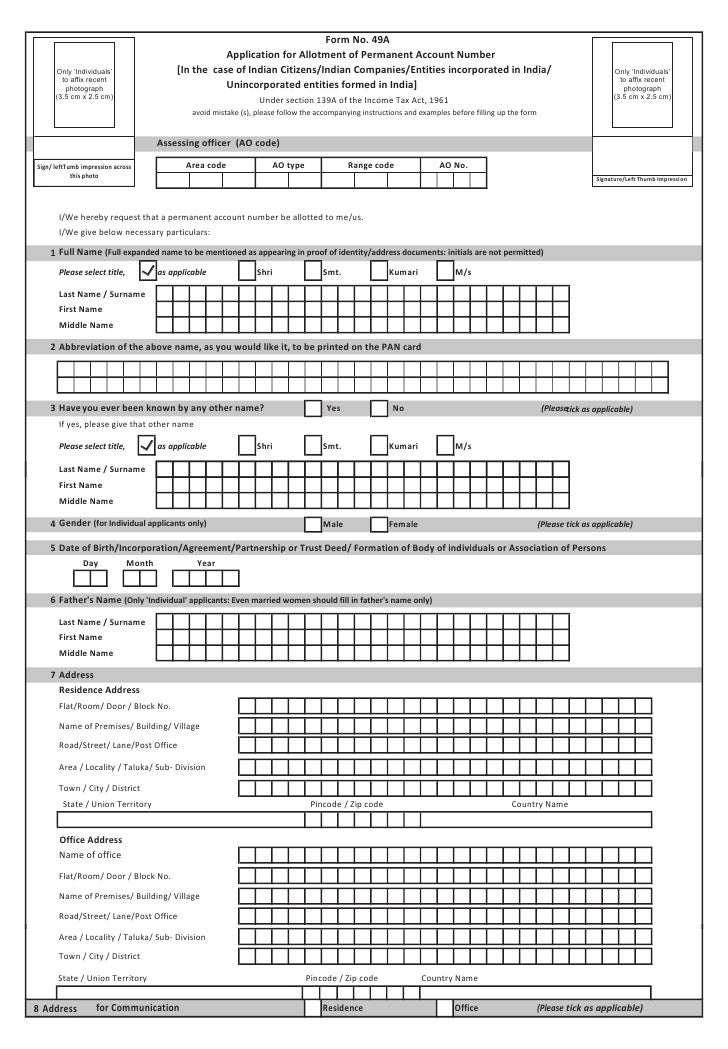

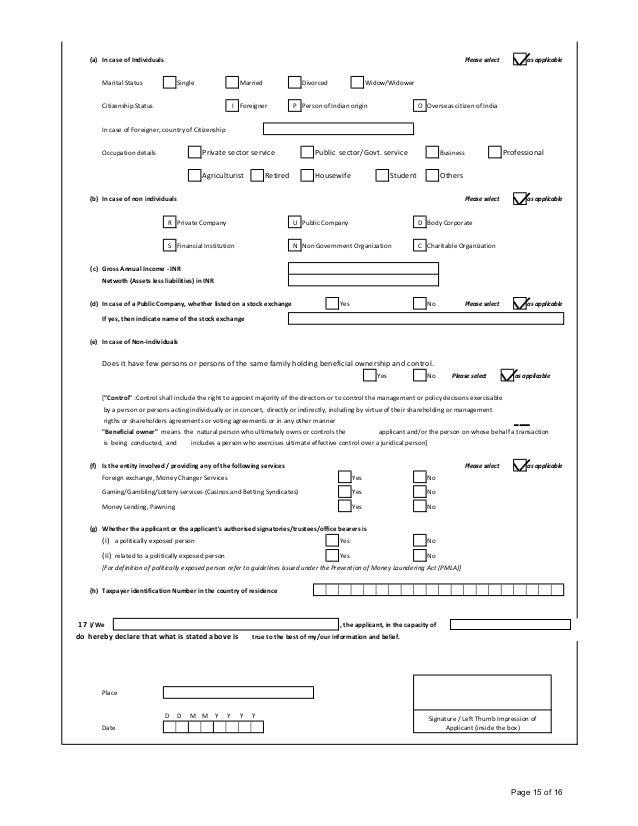

Is this answer correct. 2 and form no 49 is used to make pan card. Income tax department issues pan card form 49a under section 139a of the income tax act 1961. 49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form.

Form 49 is used to giving the particulars of directors managers and secretaries. Is this answer correct. Annual return of company having share capital. If the director is of the female gender insert f against her same.

Section 141 6 of the act provides that the company shall lodge with the registrar. Rule 114 of the income tax rules 1962. Pan application form 49 a governed under nbsp. Form is available both offline and online.

The overall goal of ctos is to prevent mental health deterioration due to medication non compliance. Pdf word updated as at 15 11 2019 19. 60 2 notification of issuance of debentures. Form 49aa is a application for allotment of permanent account number is case of individuals not being citizen of india entities incorporated outside india unincorporated entities formed outside of india.

:max_bytes(150000):strip_icc()/Screenshot49-679bd4f55caa43dd9c4735f69581bfbc.png)