What Is Form 499r 2 W 2pr

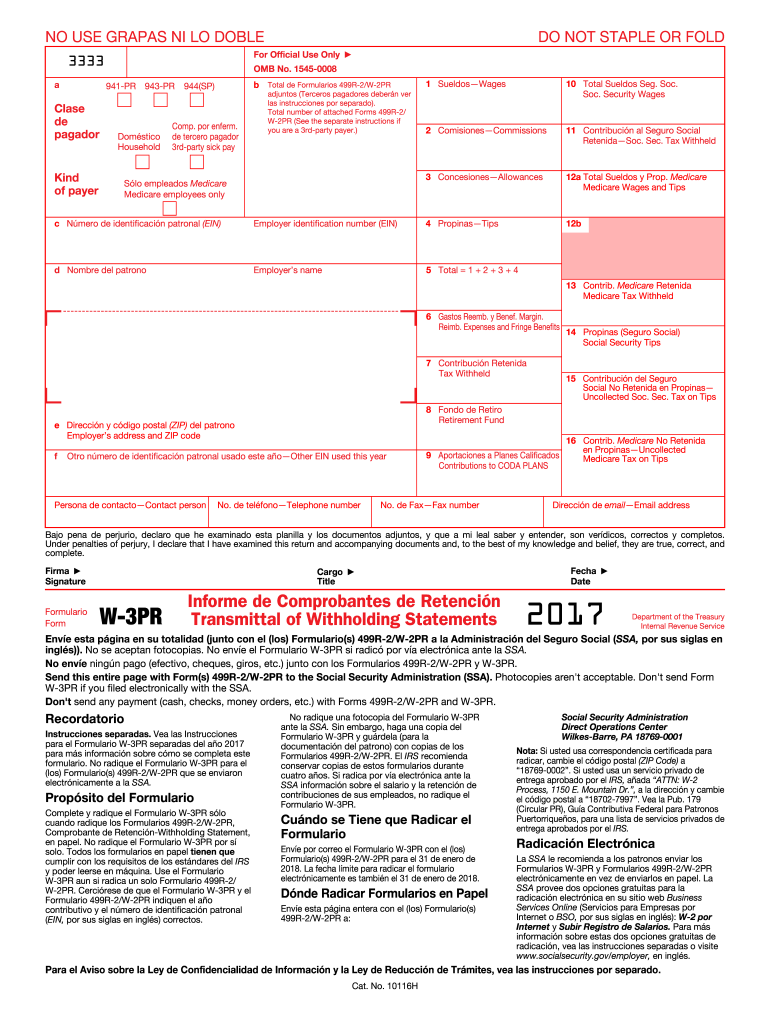

Of form as 2727 request for extension of time to file the withholding statement 499r 2 w 2pr and reconciliation statement of income tax withheld 499 r 3 starting in tax year 2015.

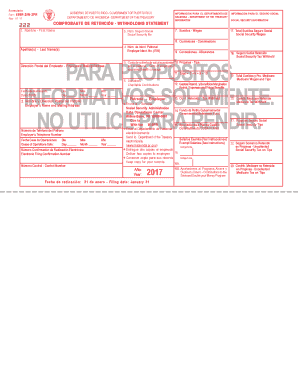

What is form 499r 2 w 2pr. While the form layout is different there are only two boxes that matter for reporting in turbotax although amounts in other boxes may be necessary to include in some of the additional questions asked if the amounts are not 0. The electronic application is available through the department s website www hacienda pr gov under the. That is there are no longer an original and copies a b c and d. The same design of printed form 499r 2 w 2pr will be used for all.

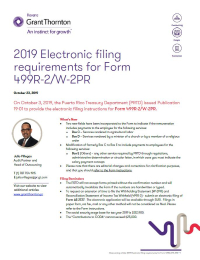

The department will not accept form 499r 2 w 2pr printed without the confirmation number handwritten or typed confirmation numbers on the forms will automatically invalid the forms. The deadline to file the 2019 form 499r 2 w 2pr with the puerto rico treasury department is january 31 2020. A 30 day extension is available by filing form as 2727 request for extension of time to file the withholding statement and reconciliation statement of income tax withheld through suri the extension will be made available on the suri portal after january 1 2020. Example of electronic filing confirmation number box on form 499r 2 w 2pr.

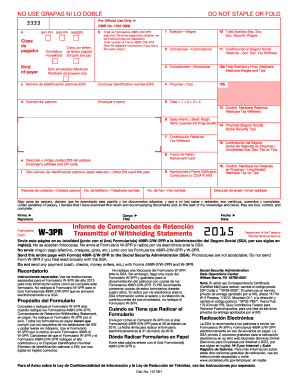

One 1 form per employee was used to report the total amount paid during the same tax period to each employee. This confirmation will be provided by suri after the filing process is complete. The puerto rico hacienda recently released forms 499r 2 and 499r 2c for tax year 2018. These forms are the puerto rico equivalent of the w 2 and w 2c respectively and must be filed with the hacienda and the social security administration by every employer that has paid wages with income tax withheld for puerto rico or to correct any submissions in the case of the 499r 2c.

What s new a box was added to include the disaster assistance qualified payments according to administrative determination 17 21. This person receives a w 2 and a w 2pr records the w 2pr on their pr return and the w 2 on their form 1040. The number will consist of ten digits starting with a letter. The same design of printed form 499r 2 w 2pr will be used for all purposes.

This number is entered in the foreign wages section. Box 7 on form w2pr are the wages. Two new fields have been incorporated to the form to indicate if the remuneration includes payments to the employee for the following services. Verify each form 499r 2 w 2pr has a printed confirmation number.

To deliver a copy to the social security administration to keep a copy for your records and to deliver two copies to the employee. Or am i just completely off base here.