What Is Form 49a In Hindi

Razi october 13 2017 pan card comments off on क य ह फ र म 49 a pan card.

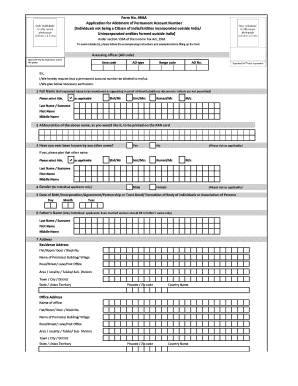

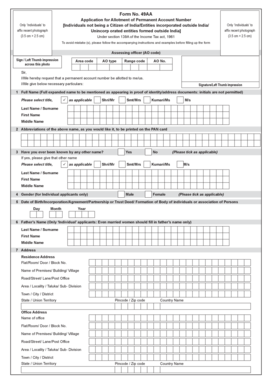

What is form 49a in hindi. F instructions for filling the form 49a. Offline procedure to get form 49a. 49aa is only meant for entities and individuals outside. Applicants are required to provide their ao code details in the application.

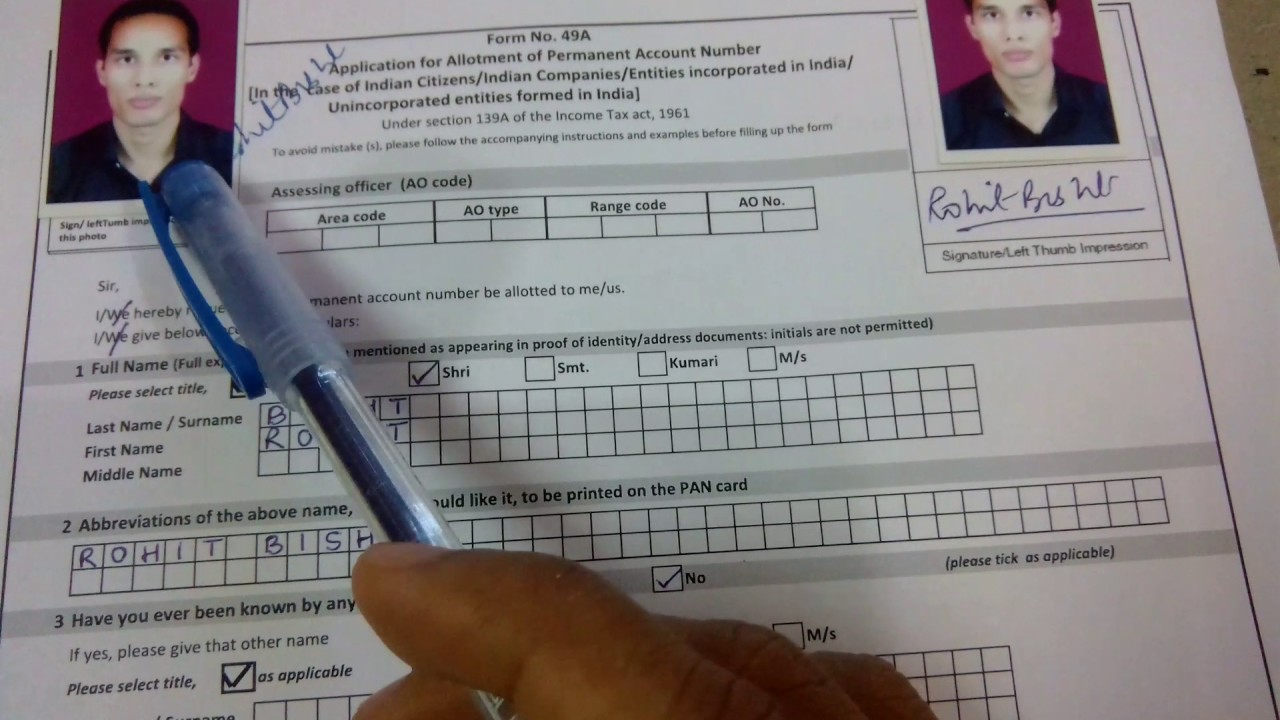

Pan is mandatory for bank accounts itr. In case you do not have a pan card and don t know how to fill pan application form 49a you need not worry as it is quite simple to apply for one. Learn how to 49a form online fill up apply for a new pan card online in india in hindi pan card ao code. As per the rules one who has never applied for a pan or does not have pan allotted to him is allowed use pan card form 49a.

49a is the form required by indian citizens and indian companies within india. What is form 49 a in hindi. Offline and online and in two primary languages english and hindi. Online procedure to get form 49a.

These details can be obtained either from the income tax office or an applicant can search for the same by selecting the appropriate option using the details provided in the form. A person applying for pan card can get the form 49a from various pan and tin service or facilitation centers of nsdl and utiisl.

So far 32 71 crore cards linked next. February 4 2018 may 10 2020 banking finance 13 comments how to correct pan card mistakes how to fill pan card application form sample how to fill pan card form i the applicant in the capacity of do hereby in capacity of pan card form pan card correction form pdf pan card form pan card initials problem pan card name change after marriage pan card name change online what to fill in. What is form 49 a in hindi 3 439 views. 49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form.

49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india under section 139a of the income tax act 1961 to avoid mistake s please follow the accompanying instructions and examples before filling up the form. Related news pan aadhaar link. Understanding the pan card application forms. Pan stands for the permanent account number.