Withholding Tax In Malaysia 2020

Tax portion of income.

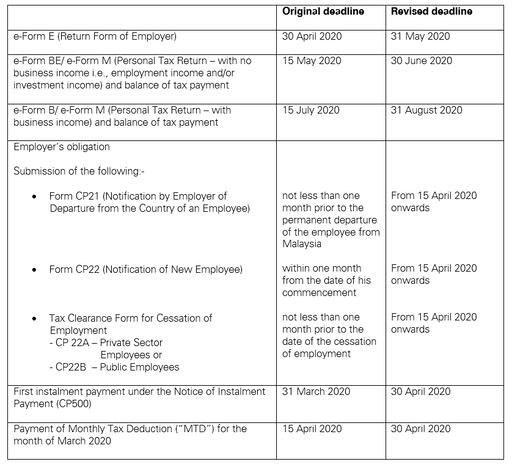

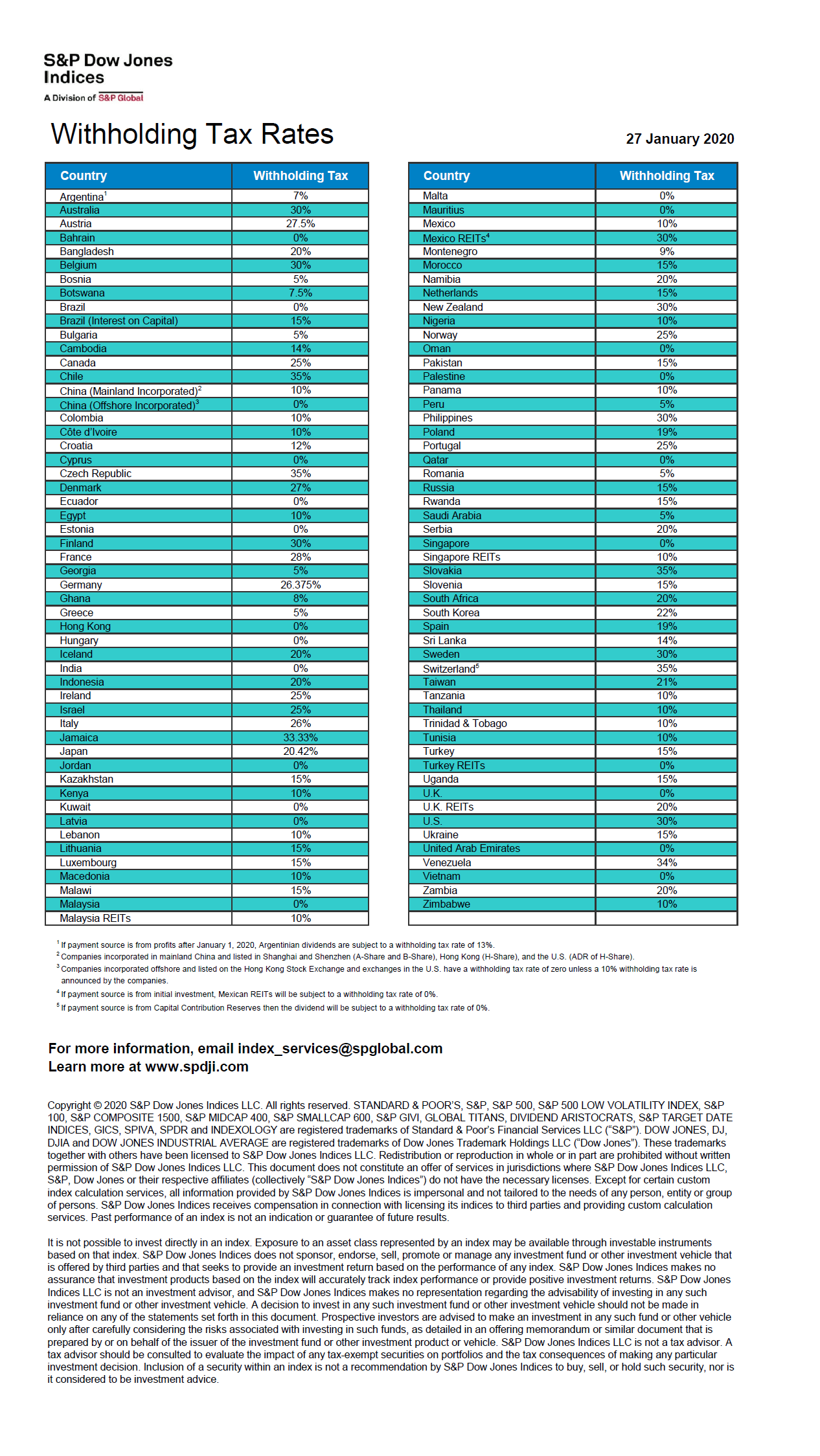

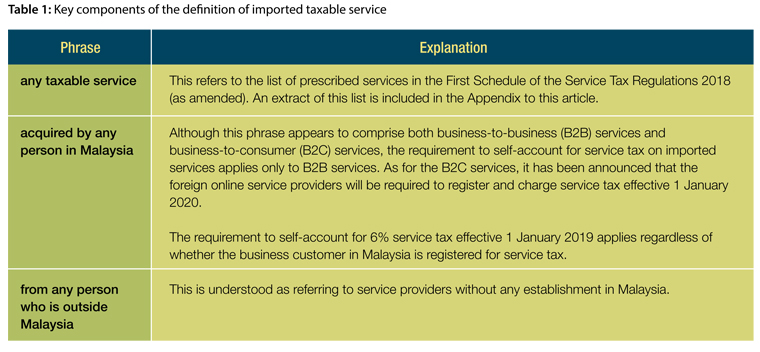

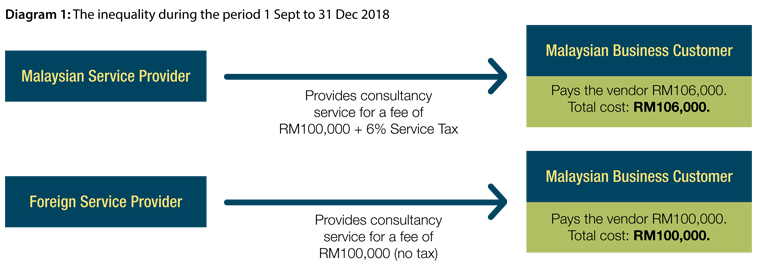

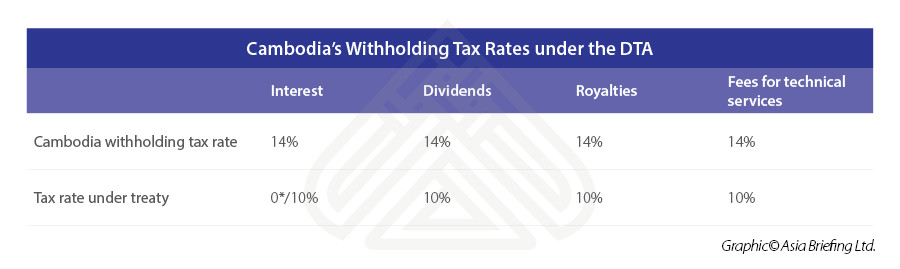

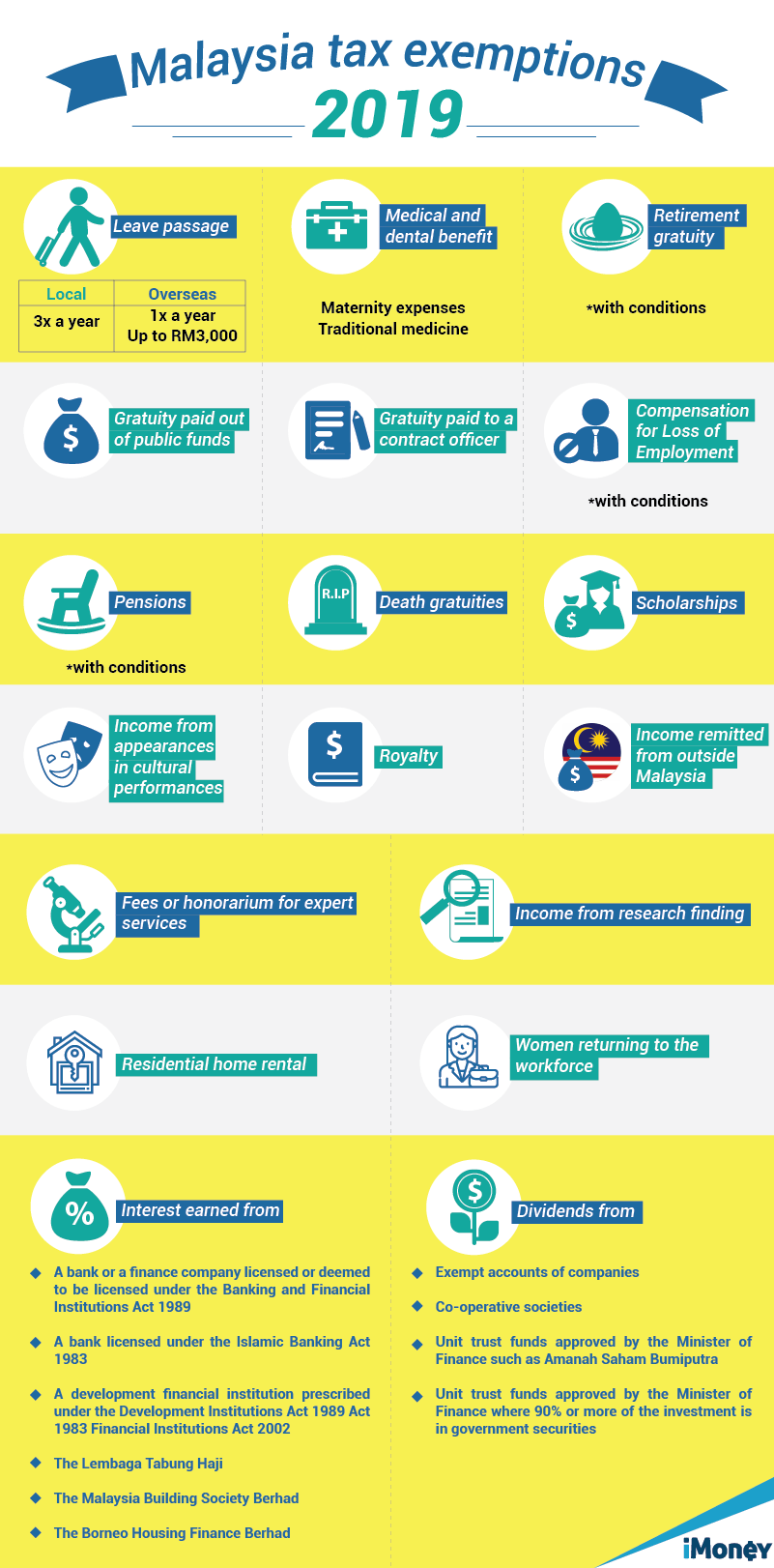

Withholding tax in malaysia 2020. The new provision under section 4a ii may provide a catch all provision for the malaysian inland revenue board mirb to subject more payments for the provision of services rendered by non residents which do not fall within the scope of other provisions in the act to withholding tax unless the services are rendered and performed outside malaysia as provided under the income tax. Malaysia highlights 2020 page 5 of 8 royalties 10 10 fees for onshore services use of moveable property 10 10 malaysia generally does not levy withholding tax on payments between residents. Introduction what is withholding tax. 2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

Payer refers to an individual body other than individual carrying on a business in malaysia. Payer refers to an individual body other than individual carrying on a business in malaysia. Withholding tax is a method of collecting taxes from non residents who have derived income which is subject to malaysian tax. Specific tax rate for specific purpose of such income.

Introduction what is withholding tax. Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irb. C resides in malaysia. Only services rendered in malaysia are liable to tax.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Some treaties provide for a maximum wht on dividends should malaysia impose such a wht in the future. Google to charge 6 digital tax in malaysia starting from jan 1 2020 digital tax can rake in rm2 4bil a year keep in mind that i m unable to give tax advice. The rates listed for nonresidents are applicable in situations in which the nonresident s income is not attributable to a business.

Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia. In simple term these are. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Interest on loans given to or guaranteed by the malaysian government is exempt from tax.

Click to know more about withholding tax and service tax. The words used have the following meaning. The gross amount of interest royalty and special income paid by the payer to a nr payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the double taxation agreement between malaysia and the country where the nr payee is a tax resident.