Withholding Tax In Malaysia For Technical Services

On 7 july 2017 the inland revenue board of malaysia irbm published practice notes1 2017 and 2 2017 of 23 june 2017 which offer guidance on the withholding of tax for contracts or services provided outside malaysia effective from 17 january 2017.

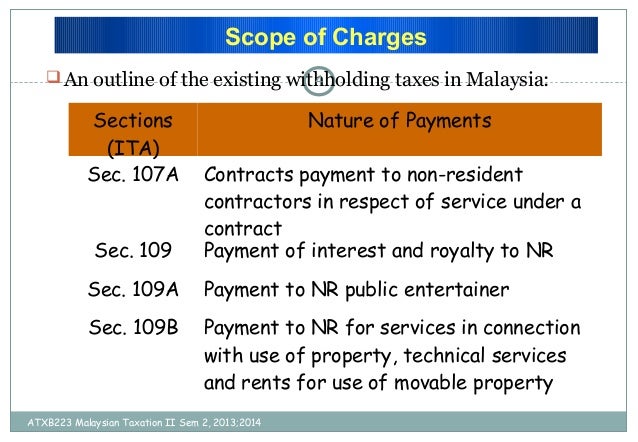

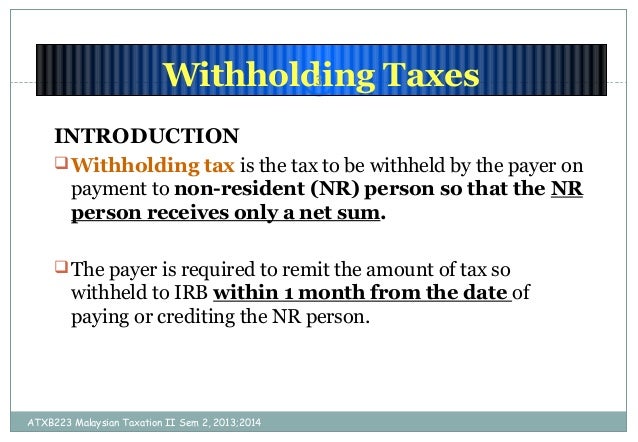

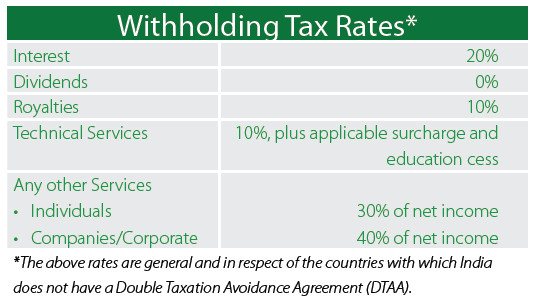

Withholding tax in malaysia for technical services. Withholding tax means an amount representing the tax portion of an income of a non resident recipient withheld by the payer in malaysia and paid directly to the inland revenue board of malaysia irb. The irb s current position is that in the absence of a technical fees fees for technical services article in a tax treaty signed by malaysia which generally would provide that such fees may be subject to wht in malaysia if they are derived from malaysia the other income income not expressly mentioned article is applicable to provide malaysia the right to tax such income. Tax portion of income. Sponsor of the nr public entertainer is required to pay withholding tax of 15 before an entry permit for the nr public entertainer can be obtained from the immigration department.

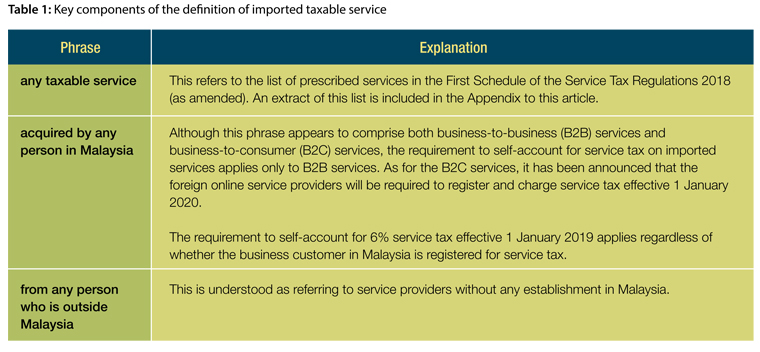

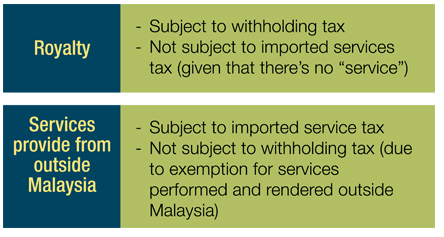

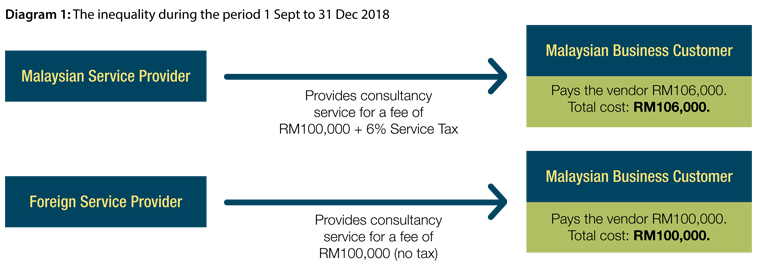

The income tax act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non resident public entertainers to a non resident person nr payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the director general of inland. W e f 28 december 2018 services liable to tax refer to any advice assistance or services rendered in malaysia and is not only limited to services which are technical or management in nature. The removal of the deleted proviso above effectively means that payments made by malaysian residents to non residents for technical services that are performed both onshore and now offshore will be subject to withholding tax under section 109b of the income tax act. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non residents is required to remit the tax deducted at an applicable rate i e.

Details of the practice notes are summarized below. However from 17 january 2017 to 5 september 2017 services rendered in and outside malaysia are liable to tax. Remuneration or other income in respect of services performed or rendered in malaysia by a nr public entertainer is subject to withholding tax of 15 on the gross payment. This deduction of tax at source does not represent a final tax which is determined upon the filing of the tax return.

In simple term these are. Withholding tax to the inland revenue board of malaysia irbm within one month from the date of paying or crediting whichever is earlier. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives.