Withholding Tax In Malaysia Principles And Latest Developments

Developing an understanding of how and when payment to non residents are subjected to withholding tax.

Withholding tax in malaysia principles and latest developments. Withholding tax is an important tax collection mechanism within the malaysian income tax system. Unit no 5 03a 5th floor menara tjb no 9 jln syed mohd mufti 80000 johor bahru. Eot for payment of withholding tax. Generally tax incentives are available for tax resident companies.

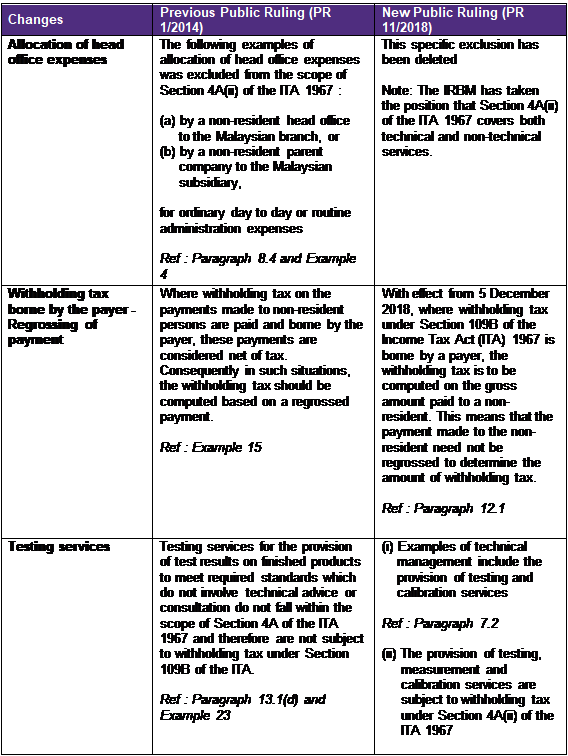

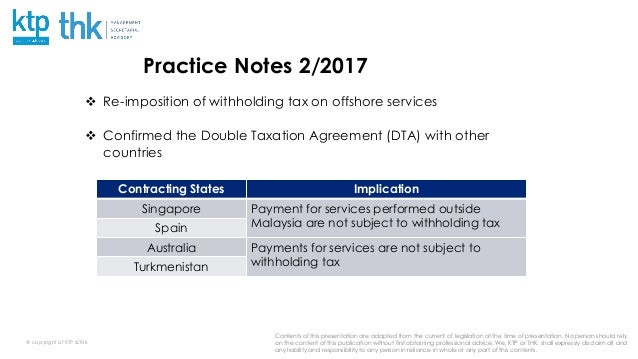

Understanding the types of payments subjected to withholding tax. Understanding the implications of the recent budget 2020 changes in relation to withholding tax is crucial in ensuring proper compliance with the income tax act. The scope of the new tax audit framework. The gross amount of interest royalty and special income paid by the payer to a nr payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the double taxation agreement between malaysia and the country where the nr payee is a tax resident.

07 227 0369. What the penalties are for non compliance. For labuan entities extension of time until april 30 2020 will be granted for furnishing of return and payment of tax. How and when payment to non residents are subjected to withholding tax.

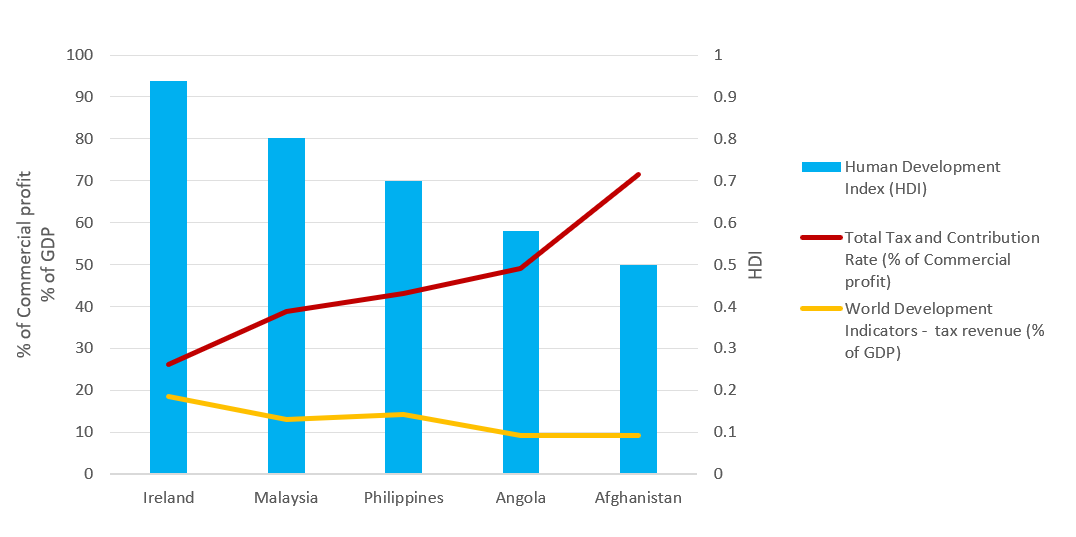

Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Currency malaysian ringgit myr foreign exchange control malaysia maintains a system of exchange controls that is subject to foreign. The latest developments on withholding tax in budget 2020. For the latest tax developments relating to malaysia see deloitte tax hand.

International tax malaysia highlights 2020 updated january 2020 recent developments. Payer refers to an individual body other than individual carrying on a business in malaysia. The income tax act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non resident public entertainers to a non resident person nr payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the director general of inland revenue. Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irb.

Introduction what is withholding tax. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. 07 222 0391.