Withholding Tax In Malaysia

Tax portion of income.

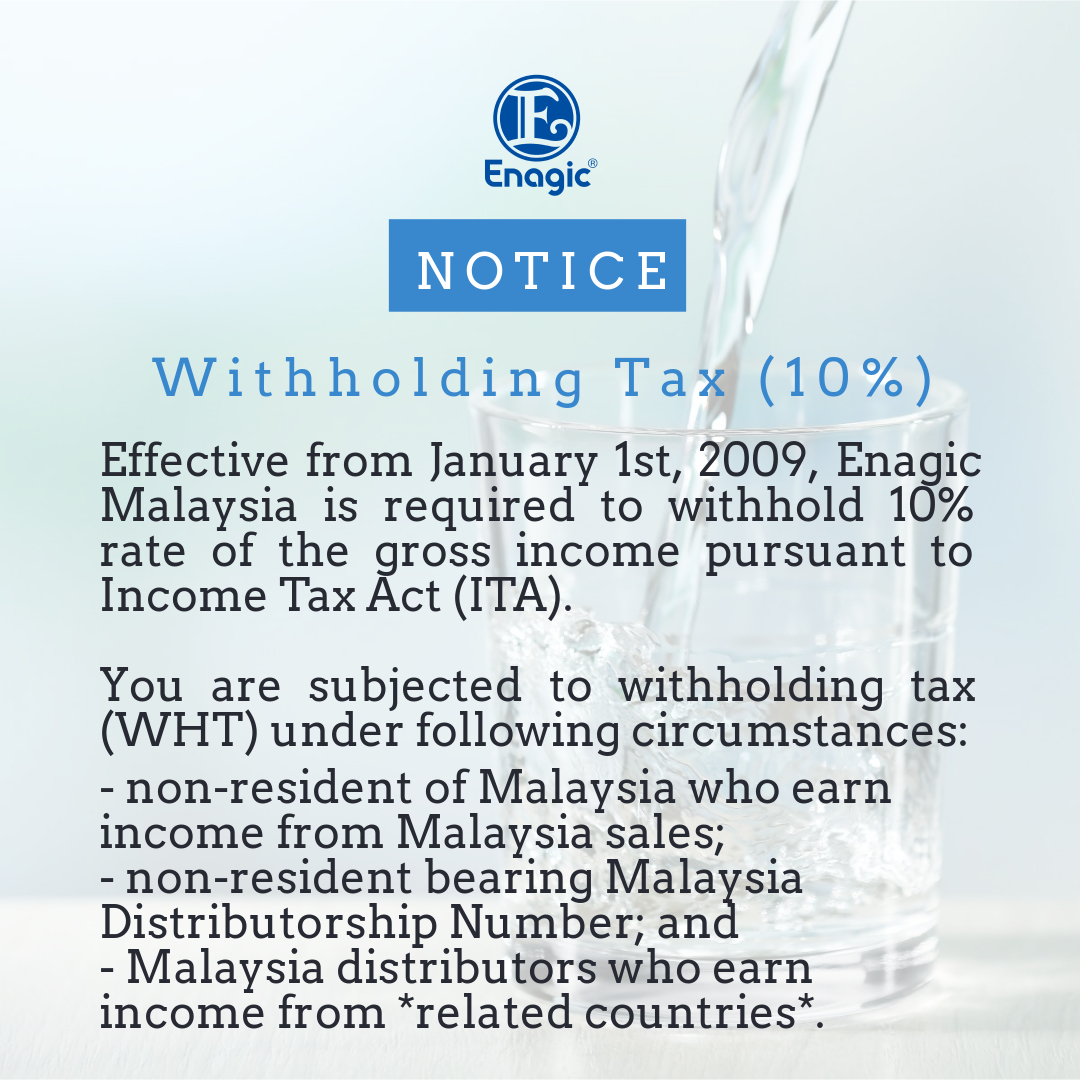

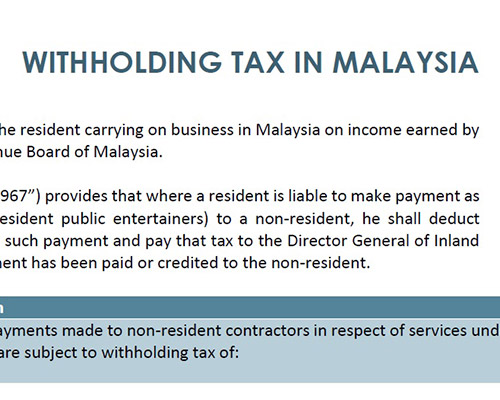

Withholding tax in malaysia. Quoting directly from the inland revenue board of malaysia s official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irbm. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Withholding tax means an amount representing the tax portion of an income of a non resident recipient withheld by the payer in malaysia and paid directly to the inland revenue board of malaysia irb. These proposals will not become law until their enactment and may be amended in the course of their passage through.

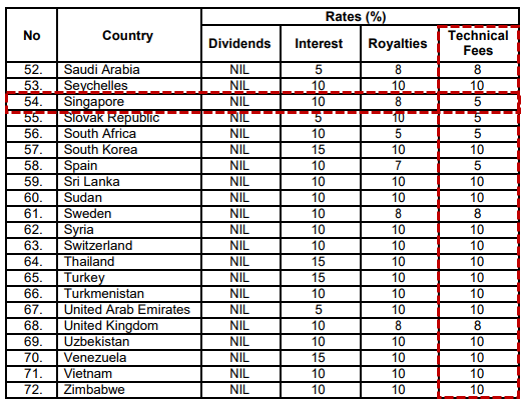

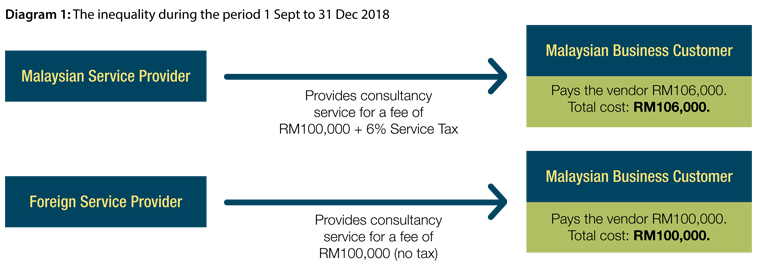

In simple term these are. The rates listed for nonresidents are applicable in situations in which the nonresident s income is not attributable to a business carried on in malaysia and may be reduced under a tax treaty as noted below. Malaysia generally does not levy withholding tax on payments between residents. Some treaties provide for a maximum wht on dividends should malaysia impose such a wht in the future.

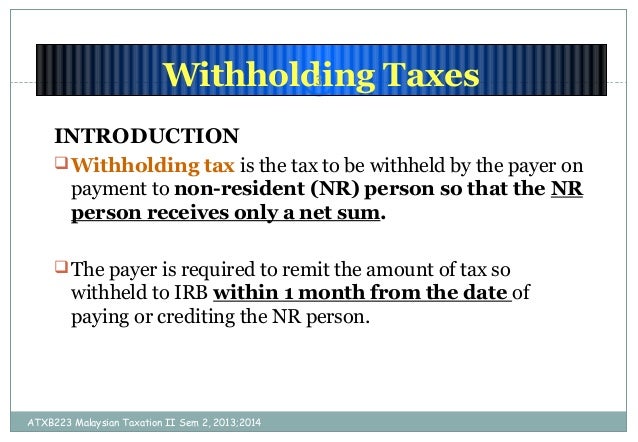

What is withholding tax in malaysia. Income that a nonresident derives from malaysia from special classes of income is subject to tax in malaysia. Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia. The words used have the following meaning.

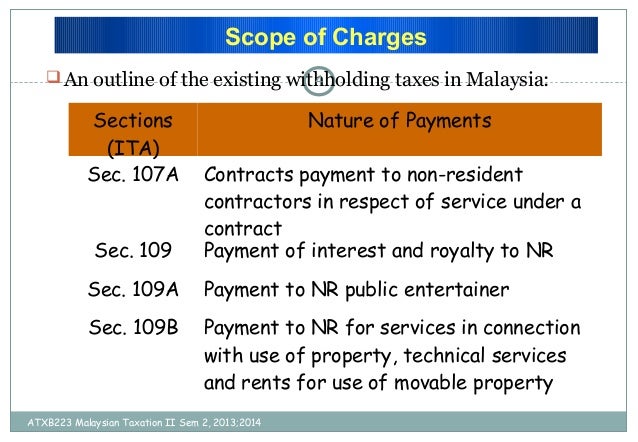

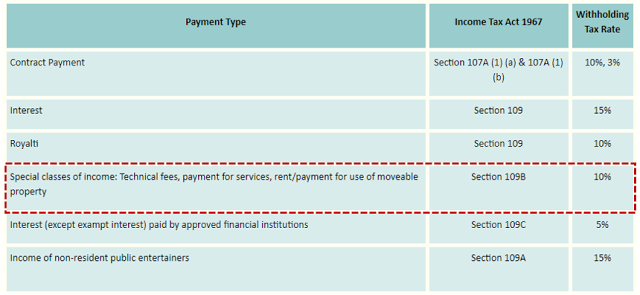

Depend on complexity of the advisory work and time cost incurred. Introduction what is withholding tax. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. The special classes of income are those listed in section 4a of the income tax act 1967 ita.

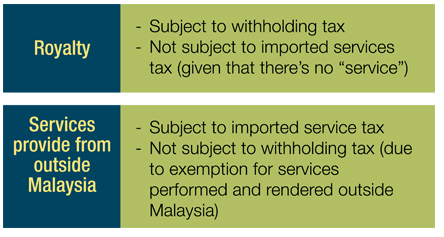

Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irb. Malaysia has no wht on dividends in addition to tax on the profits out of which the dividends are declared. Specific tax rate for specific purpose of such income. The prevailing wht rate is 10 except where a lower rate is provided in an applicable tax treaty.

Introduction what is withholding tax. Any tax resident person who is liable to make certain specified types of payments to a non resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the malaysian irb within one month of paying or crediting. Payer refers to an individual body other than individual carrying on a business in malaysia. Malaysia is subject to withholding tax under section 109b of the ita.