E Filing Malaysia 2016

Sekiranya anda memasukkan no.

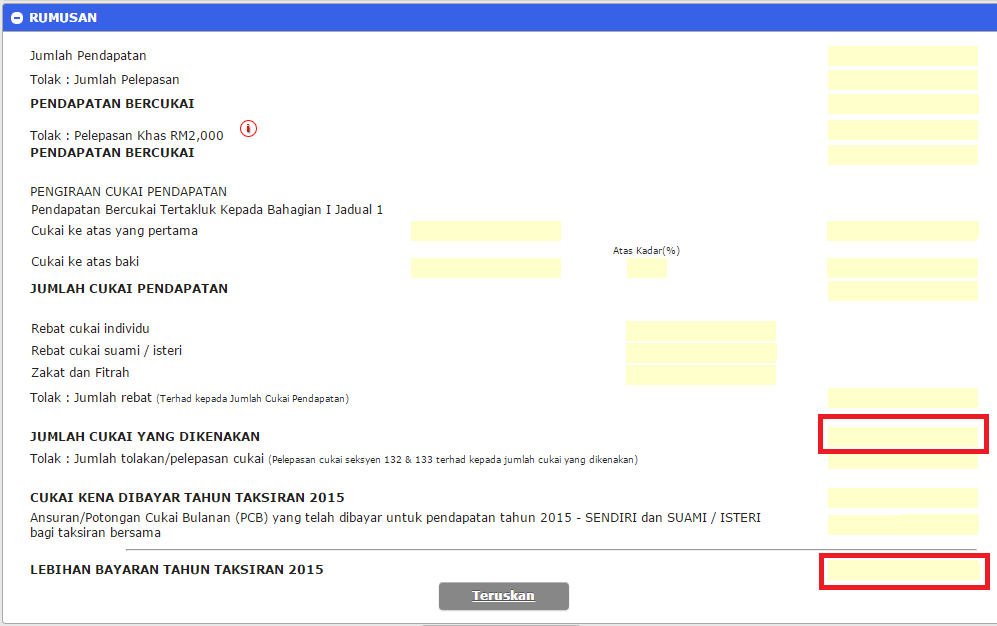

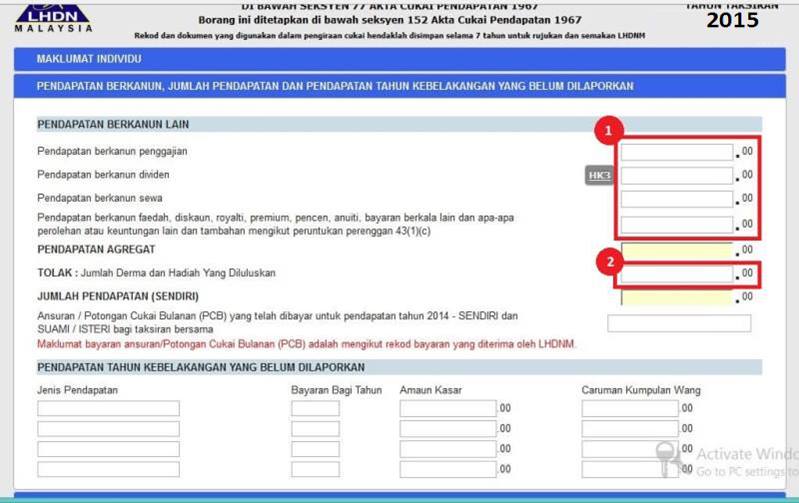

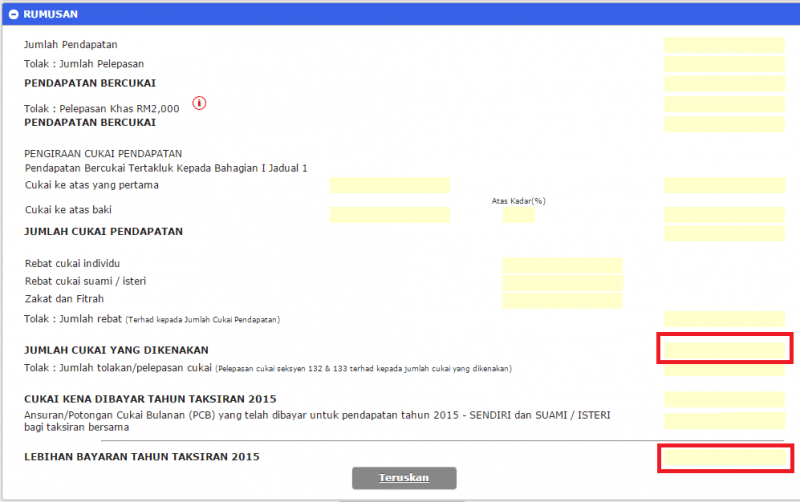

E filing malaysia 2016. 2017 12 05 14 53 44 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Malaysia has a progressive income tax system which means the more you earn the more you will need to pay. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e filing melalui ejen cukai. Pelepasan 15 anak di bawah umur 18 tahun.

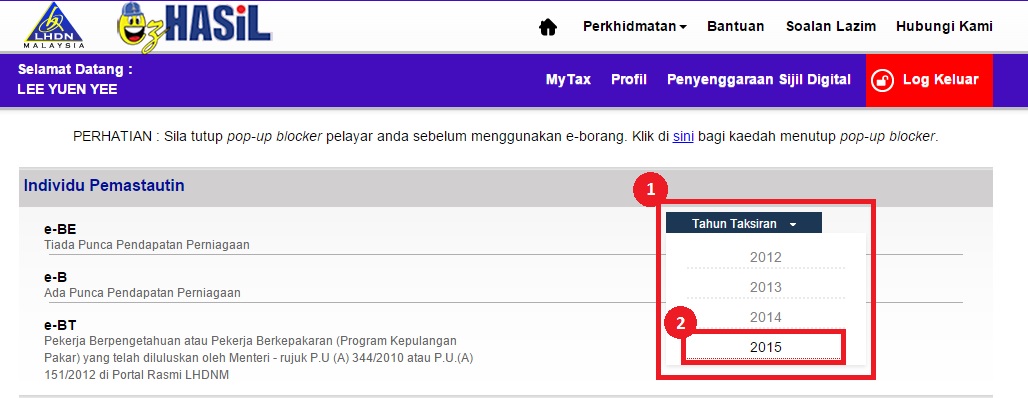

Tax rates are progressive so you only pay the higher rate on the amount above the rate i e. Form e filing tax agent e filing taef e c 1 april 2016 1 april 2016. Consequently when taxpayers use e filing they fear that their personal security may be threatened lu et al 2005. Filing your tax through e filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on april 30.

Bagi pelepasan cukai pendapatan 2016 jumlah layak tuntut telah ditingkatkan bagi kategori ini. Jika punyai 10 orang anak berumur bawah 18 tahun dan belum berkahwin maka. Ezhasil e filing is a most convenient way to submit income tax return form itrf. Jika mempunyai anak di bawah umur 18 tahun dan belum berkahwin maka layak menuntut pelepasan cukai pendapatan sebanyak rm 2 000 atas seorang anak.

Tax rates are on chargeable income not salary or total income chargeable income is calculated after tax exemptions and tax reliefs more below. Form e remuneration for the year 2015 3 1 due date for submission of form e. Following the tabling of budget 2016 it was announced that high income earners who are earning more than rm1 million per annum will be charged 28 income tax which is an increase of 3 from the previous year. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic.

For year of assessment 2016 the e filing system for companies will be made available with effect from the following date. Despite the rapid adoption of e filing in malaysia the system is still unreliable especially at. Jika ini adalah kali pertama anda menggunakan e filing tekan tidak dan lakukan login kali pertama atau semak semula no. Obviously this will prevent taxpayers from adopting e filing.

You will never have less net income after tax by earning more. Pasport baru dan pernah menggunakan e filing tekan ya. Tiada had bilangan anak. Pasport yang anda masukkan tiada dalam rekod.

Click link to e filing. Malaysia personal income tax rates two key things to remember.