Monthly Tax Deduction Malaysia 2020

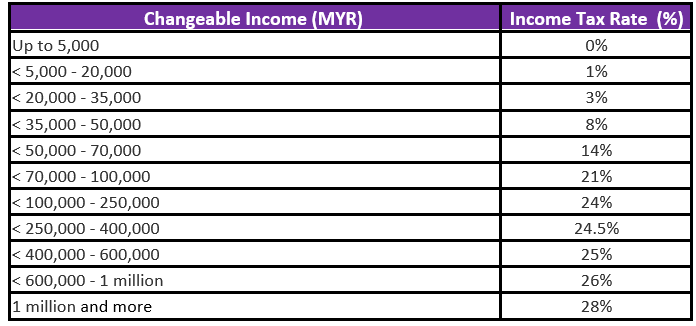

Review of income tax rates and income tax structure a.

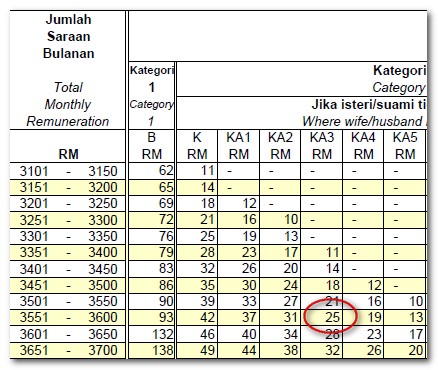

Monthly tax deduction malaysia 2020. Malaysia income tax deduction ya 2019 donations a tax deduction reduces the amount of your aggregate income which the sum of your total income for the year put together. Guidelines for monthly tax deduction under income tax deduction from remuneration amendment no. With a separate assessment both husband. The acronym is popularly known for monthly tax deduction among many malaysians.

Therefore these monthly deductions are net of all possible tax relief tax rebate and zakat payments. Calculation method of monthly tax deduction mtd 2020 are as follows. Malaysia income tax e filing. For income tax filing in the year 2020 ya 2019 you can deduct the following contributions from your aggregate income.

2 rules 2015 in malay version only lampiran a table monthly tax deduction 2016 specification for mtd calculation using computerised calculation for 2016. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. What is tax rebate. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. What is a tax deduction.

What is income tax return. The calculator is designed to be used online with mobile desktop and tablet devices. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. Pcb stands for potongan cukai berjadual in malaysia national language.

The monthly wage calculator is updated with the latest income tax rates in malaysia for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Started from malaysia income tax year of assessment 2014 tax filed in year 2015 employees are not required to file their income tax return if such monthly tax deductions mtd constitute their final tax. All married couples have the option of filing individually or jointly.