Public Bank Cash Cheque Sample

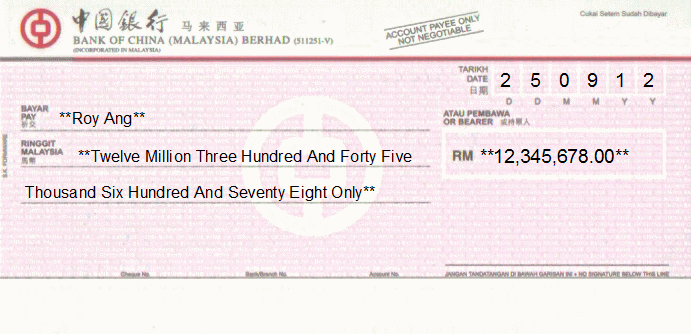

In some cases you may also be required to initial near the written and numerical amounts of the cheque.

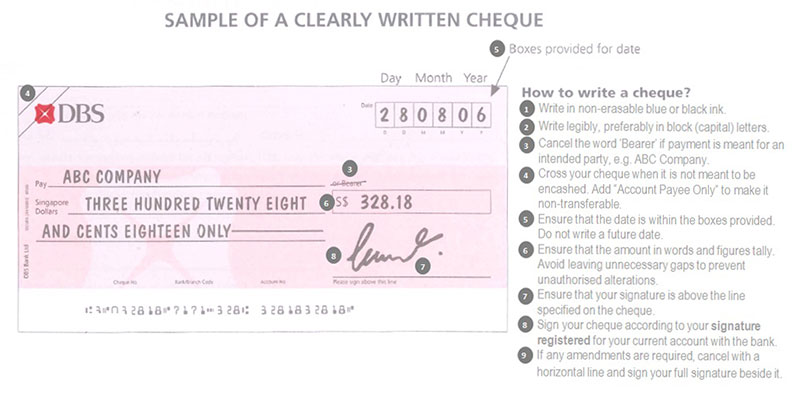

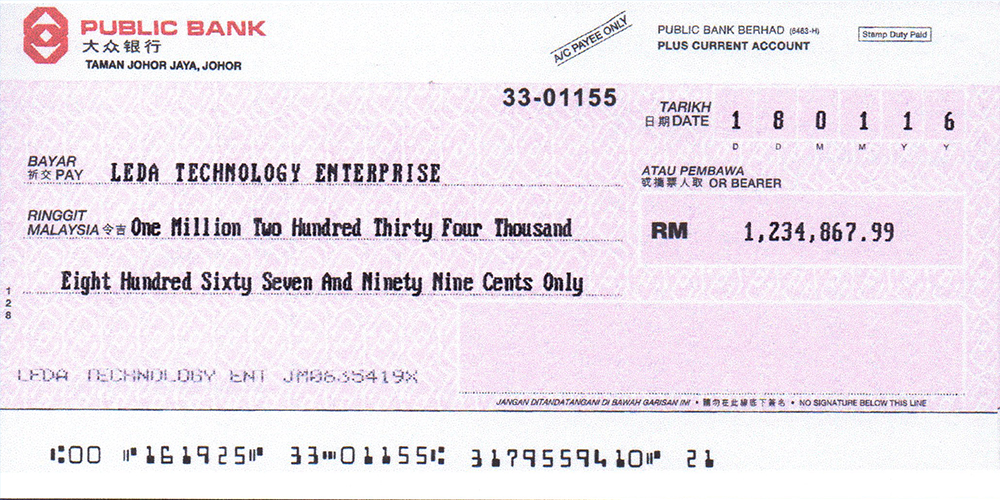

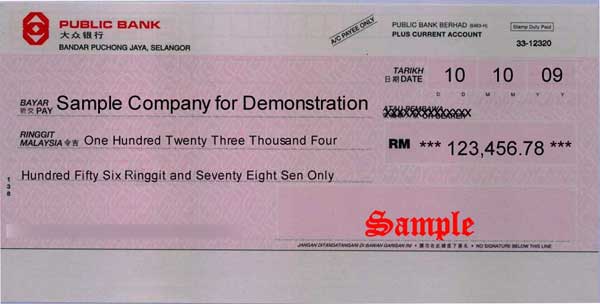

Public bank cash cheque sample. Using non public bank non public islamic bank cheques rm2 00 per transaction. Three cheques of 2 000 1 500 and 2 500 were deposited in the bank on 30 th december 2018 but were recorded in the bank statement in january 2019. If any amendments are required cancel with a horizontal line and sign your full signature beside it. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

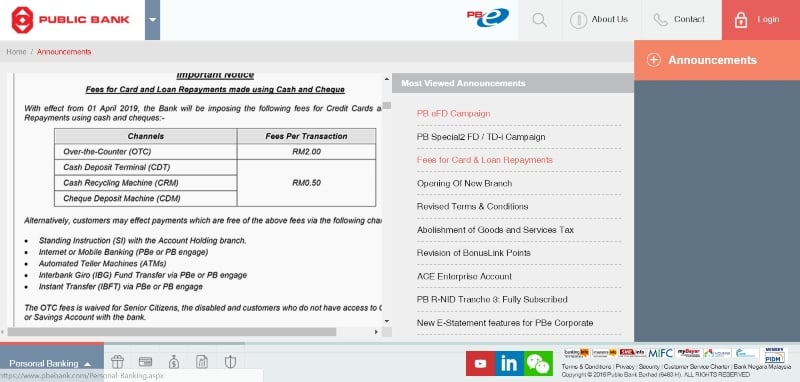

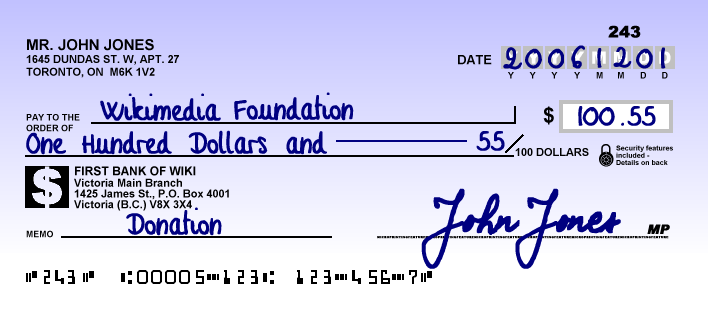

To endorse the cheque to another person write pay to the order of on the reverse side of the cheque. Public bank has recently announced that it will impose fees on any loan and credit card repayment using cash and cheques starting april 2019. You will need to provide your full name as per bank s records your bank account number and your contact number at the back of the cheque before depositing it at our quick cheque facilities. Rm5 00 per page plus rm10 00 per request for cheque images not available in branch s database.

If the check gets lost or stolen you and your bank will have to watch for a fraudulent transaction. Cheque of 500 issued on 31 st december 2018 was not presented for payment. Authorization letter to collect cheque from bank. In an announcement on public bank s website customers who repay their credit card balance or loans over the counter will be required to pay a rm2 00 fee for each transaction.

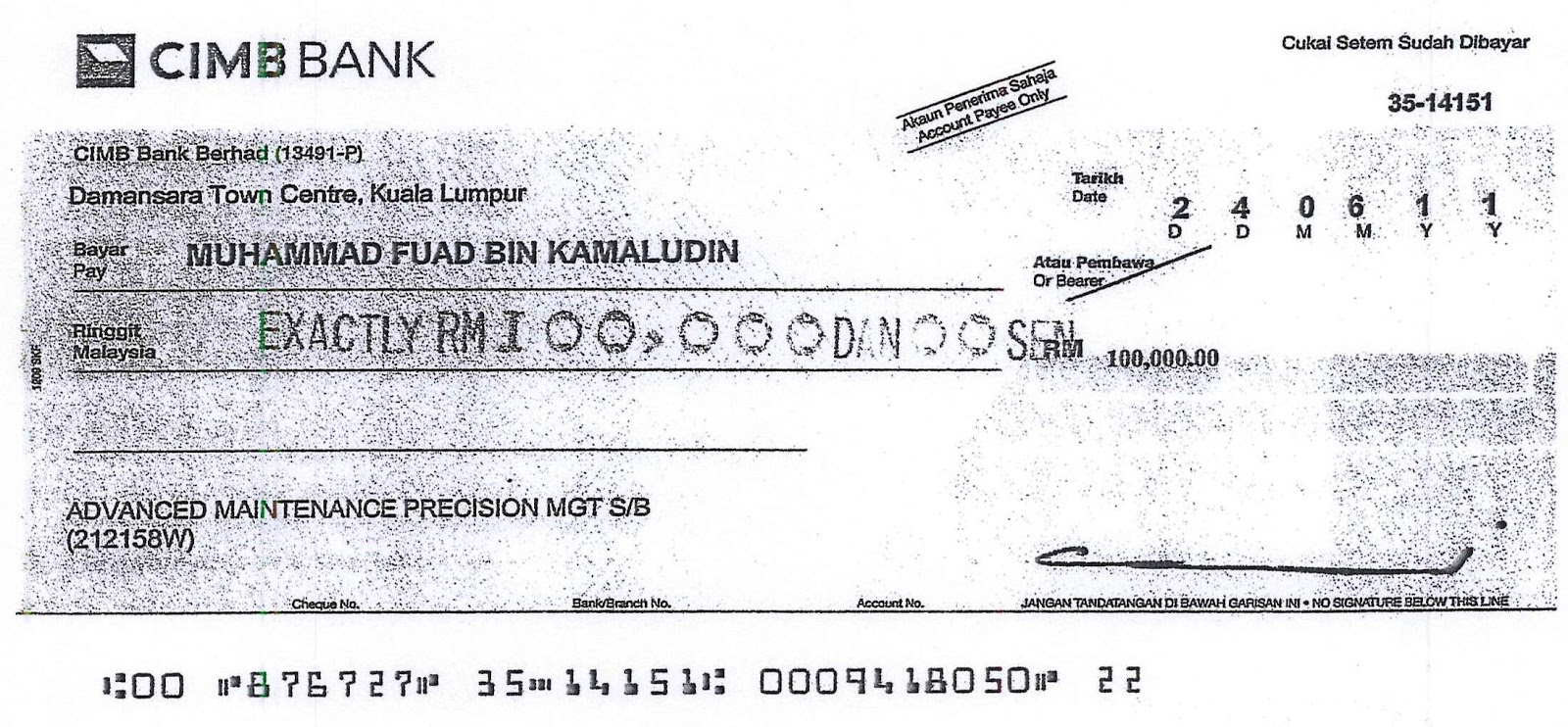

In both of the above scenario you can authorize some third person on your behalf who can collect cheque book from bank and can also collect the payment of the cheque this is such a very convenient and the useful authorization letter which can be of the great. Cross out the bearer word on the cheque and double cross on the top left corner of the cheque if it has to be paid only to the said payee. These are the other details. What are the details i need to provide on the cheque to deposit.

Why not pay to cash. Rm4 00 per transaction. Has a balance in a passbook of 10 000 as on 31 st december 2018. Bank reconciliation example 2.

If you re unable to catch it in time you have to take legal action against whoever deposits the check to recover your money. Write the full name of the payee as per the payee s bank records on the pay line. They can then cash the cheque with their bank and give you the money. Sign your cheque according to your signature as per bank s records.

Collection of over the counter statutory payments for government agencies using cash or public bank public islamic bank cheques.