Income Tax Rate In Pakistan 2018 19

400 000 then the rate of income tax is 0.

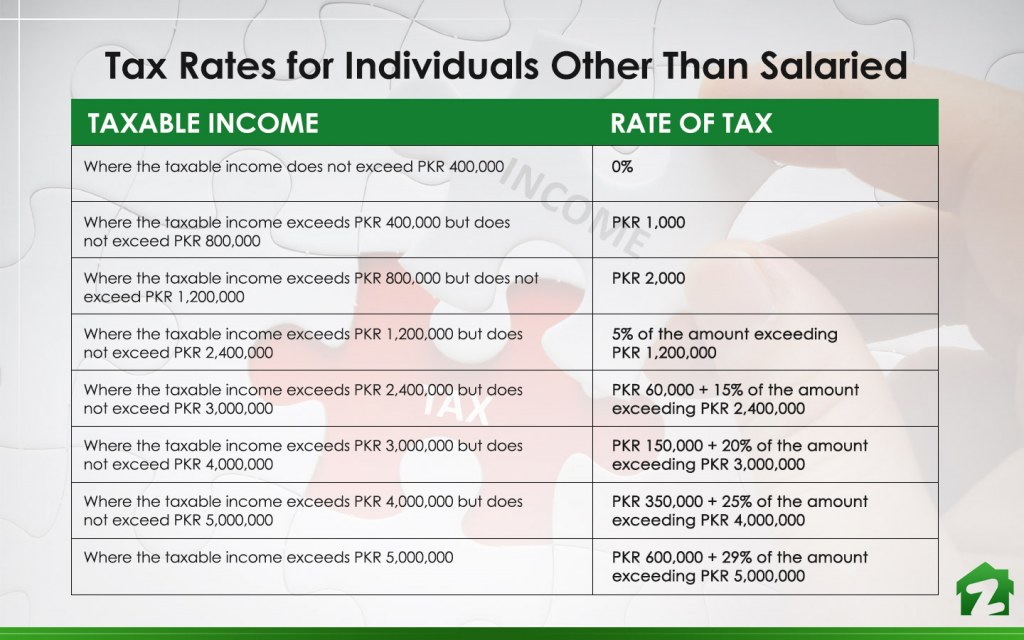

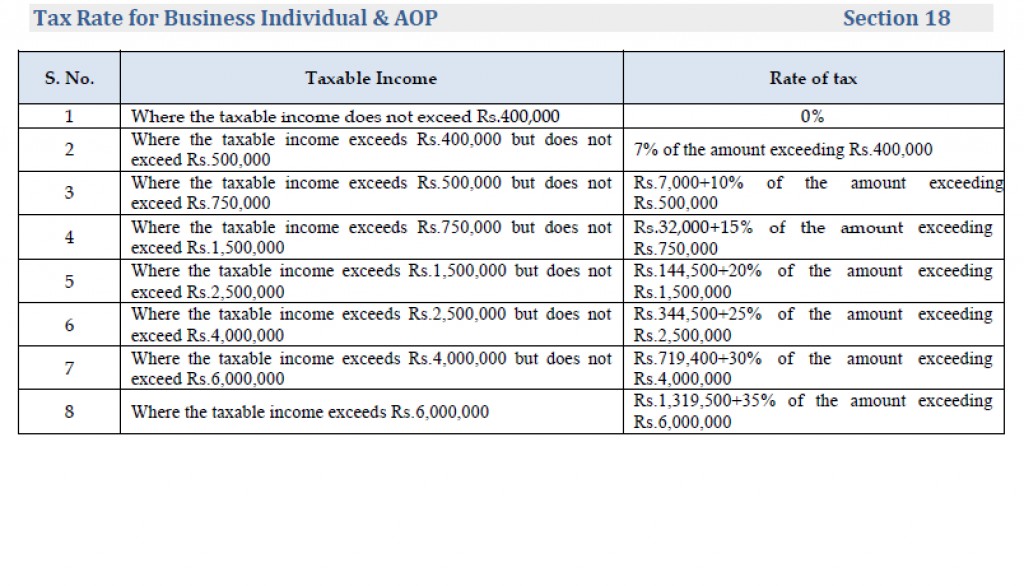

Income tax rate in pakistan 2018 19. Income tax rates 2018 19 pakistan. If your salary is rs. Majority of these payments do not attract enhancement of 100 even if the recipients are. Income tax slabs for non salary business individual.

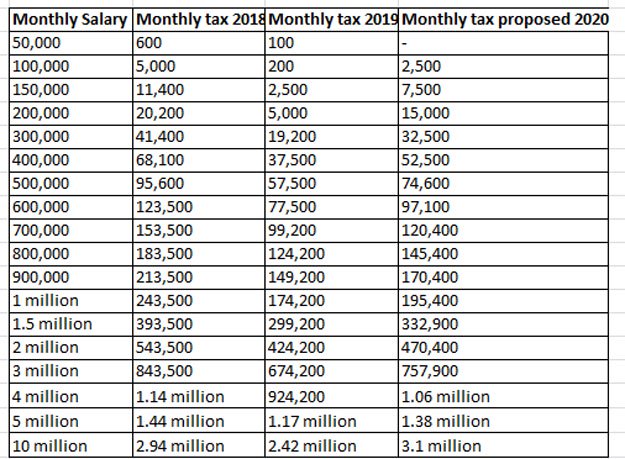

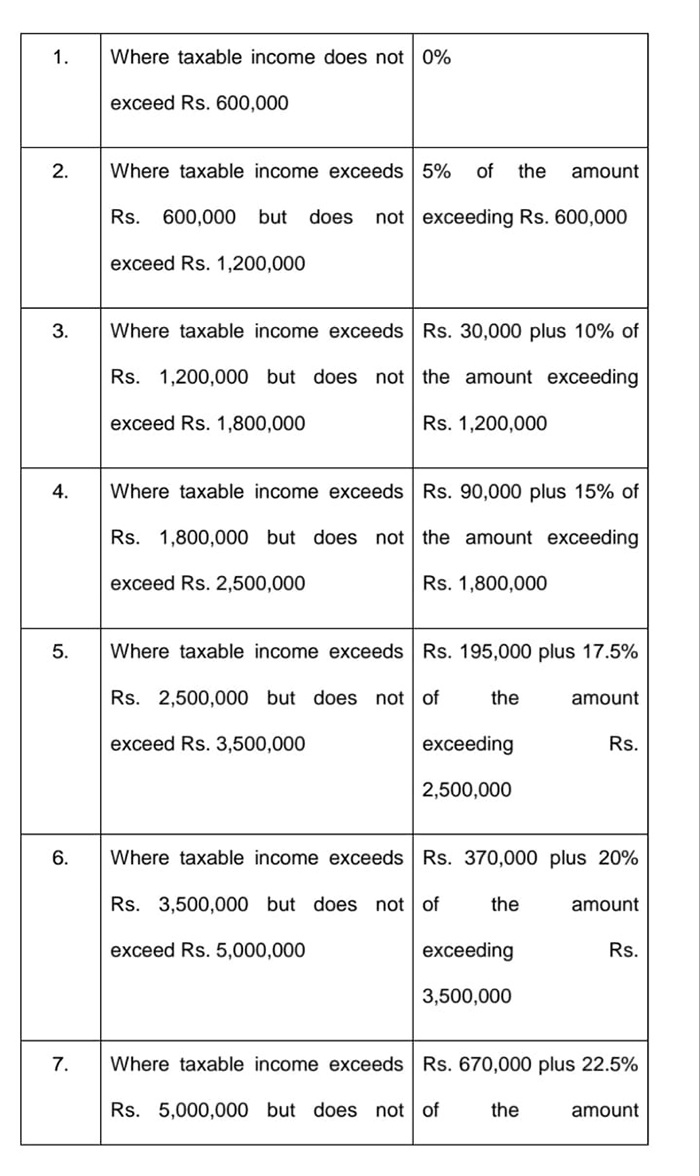

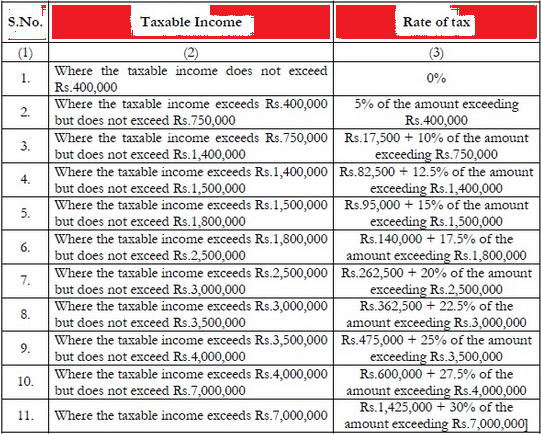

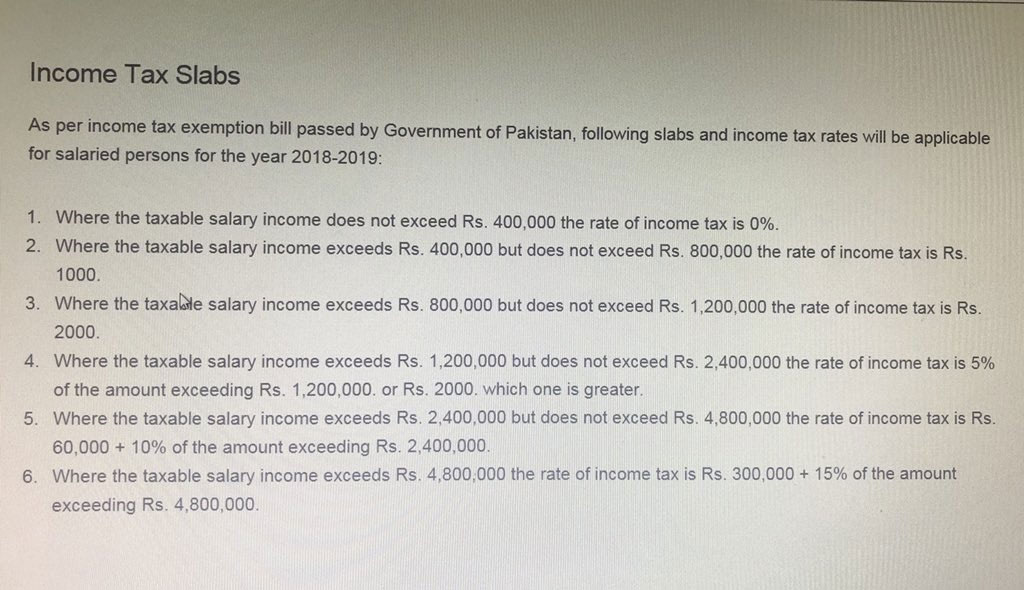

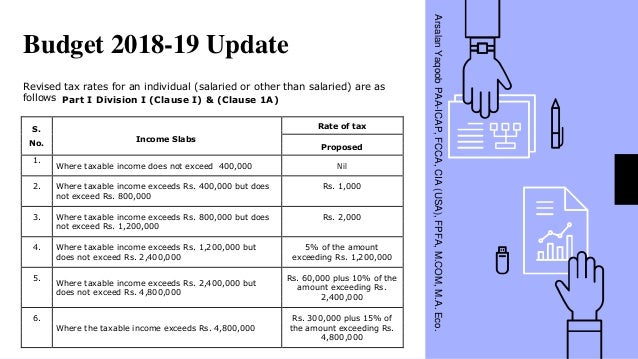

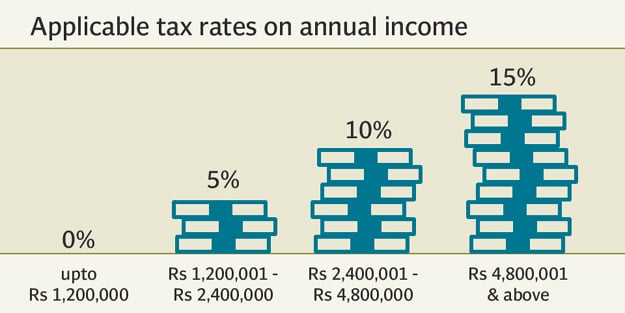

As per finance supplementary amendment bill 2018 passed by government of pakistan in september 2018 following slabs and income tax rates will be applicable for. Pakistan budget digest 2018 19. When you will earn between rs. In general payments made on account dividend interest royalties and fee for technical services income derived from pakistan sources are subject to a 15 withholding tax wht which tax has to be withheld deducted from the gross amount paid to the recipient.

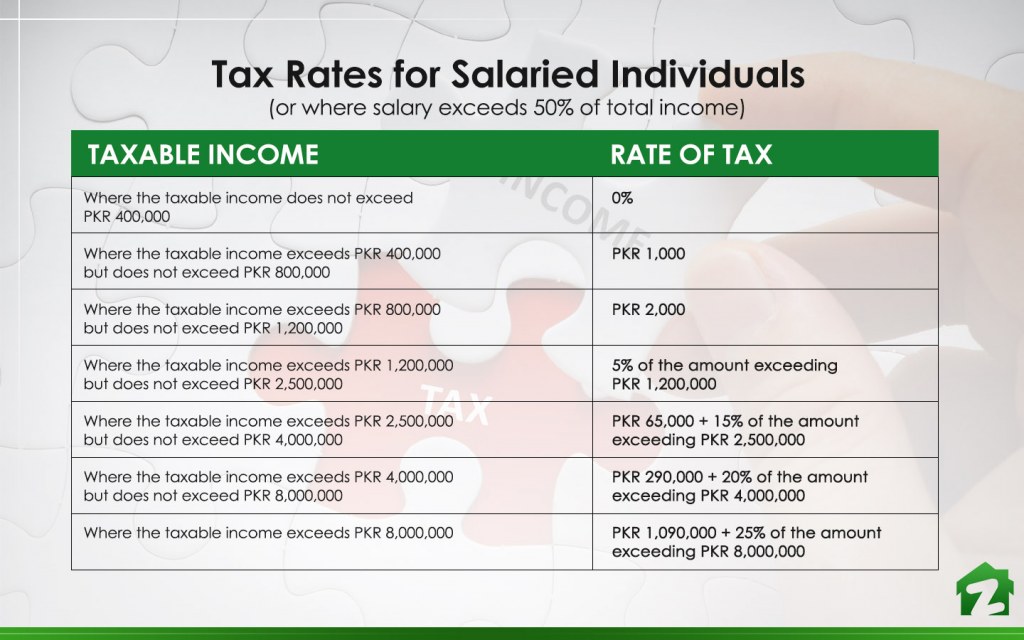

Where the taxable salary income does not exceed rs. Where the taxable income exceeds rs. Taxes on director s fee consultation fees and all other income. Maximum tax rate has been reduced to 15 from 35 individuals other than salaried and 30 salaried individuals.

Salary received or receivable from any employment exercised in pakistan wherever paid. As per income tax exemption bill passed by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018 2019. Taxes on employment income. The personal income tax rate in pakistan stands at 35 percent.

400 000 the rate of income tax is 0. 1 090 000 25 of the amount exceeding rs. 8 000 000 the rate of income tax is rs. This page provides pakistan personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

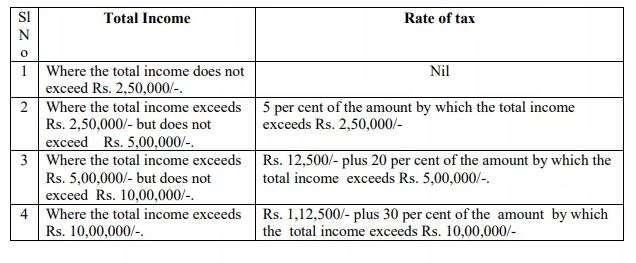

The employment income of non residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount. Income tax slab rate for ay 2018 19 for individuals. Income tax rates 2018 19 pakistan. Is defined in section 101 of the income tax ordinance 2001 which caters for incomes under different heads and situations.

An income tax bill of following slabs and income tax rates passed by the government of pakistan will be applicable for salaried persons for the year 2018 2019. Member of morrison ks international. 1 1 individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year. Some of the common pakistan source incomes are as under.

House for sale in model town lahore house for sale in old officers colony lahore cantt house for sale in sarwar colony lahore cantt house on installment in lahore johar town house.