Monthly Tax Deduction Malaysia

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

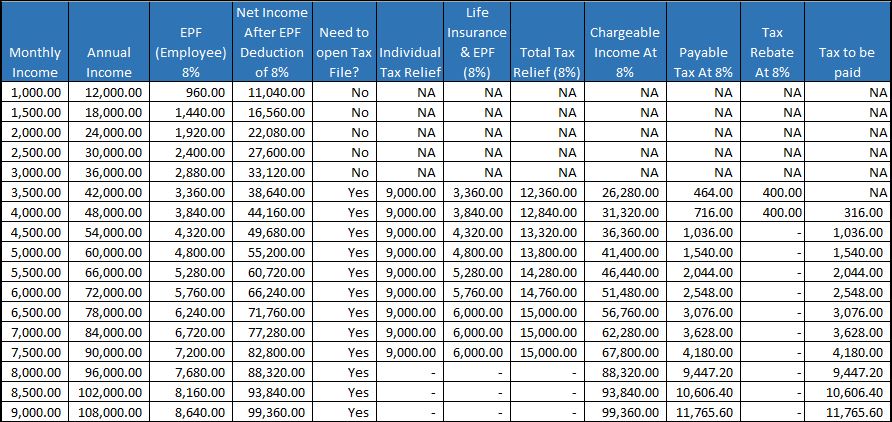

Monthly tax deduction malaysia. Regardless of whether you are an employee or employer the next article will surely be useful to you. Now that you know what malaysia s monthly tax deduction mtd pcb is all about the next article part 2 of 3 will show you how to calculate it and how contributions are made from your monthly salary. Determine the tax deduction on monthly remuneration not including additional remuneration. Determine the tax deduction on additional remuneration.

Calculation method of monthly tax deduction mtd 2019 are as follows. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. Current position currently an individual income taxpayer is eligible to claim income tax relief on contributions made to. This mechanism is designed to avoid the issues that come with requiring payment of a large sum of income tax when the actual tax amount has been determined.

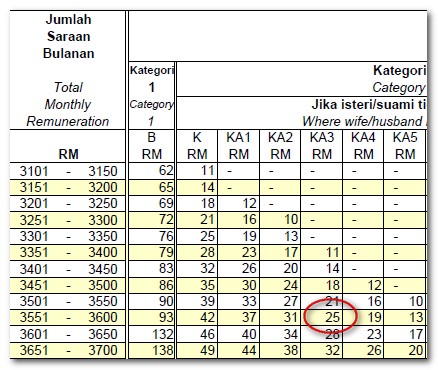

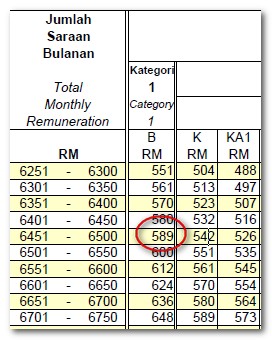

Total amount of tax to be deducted in the month that bonus is paid will be a d. Schedule of monthly tax deductions and the computerised calculation method classifies employee into 3 categories. 1 12 x nett bonus monthly net remuneration. Schedule of monthly tax deductions schedule of monthly tax deductions is issued by inland revenue board of malaysia irbm for employer who does not use computerised payroll software.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Employer s responsibilities under the monthly tax deduction mtd rules are as follows. Malaysia income tax e filing. What is tax rebate.

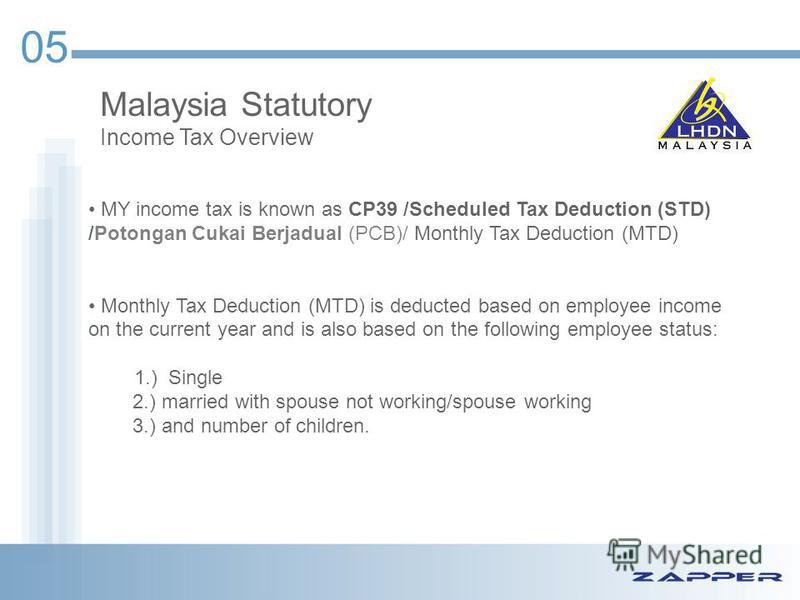

Monthly tax deduction mtd or pcb potongan cukai bulanan was introduced in january 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the pcb deduction schedule. Determine the tax deduction on b. Mtd as final tax starting from malaysia income tax year of assessment 2014 tax filed in 2015 taxpayers who have been subjected to mtd are not required to file income tax returns if such monthly tax deductions constitute their final tax. How does monthly tax deduction mtd pcb work in malaysia.

All married couples have the option of filing individually or jointly. Deduct the mtd from the remuneration of employee in each month or the relevant month in accordance with the schedule of monthly tax deductions or computerised calculation method and pay to the director general. Monthly tax deductions mtd also known as potongan cukai bulanan pcb in malay is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. With a separate assessment both husband.

How does monthly tax deduction mtd pcb work in malaysia. Review of income tax relief on contribution to an approved provident fund or takaful or life insurance premiums. What is income tax return.